CBO Score H.R. 1628, Better Care Reconciliation Act of 2017

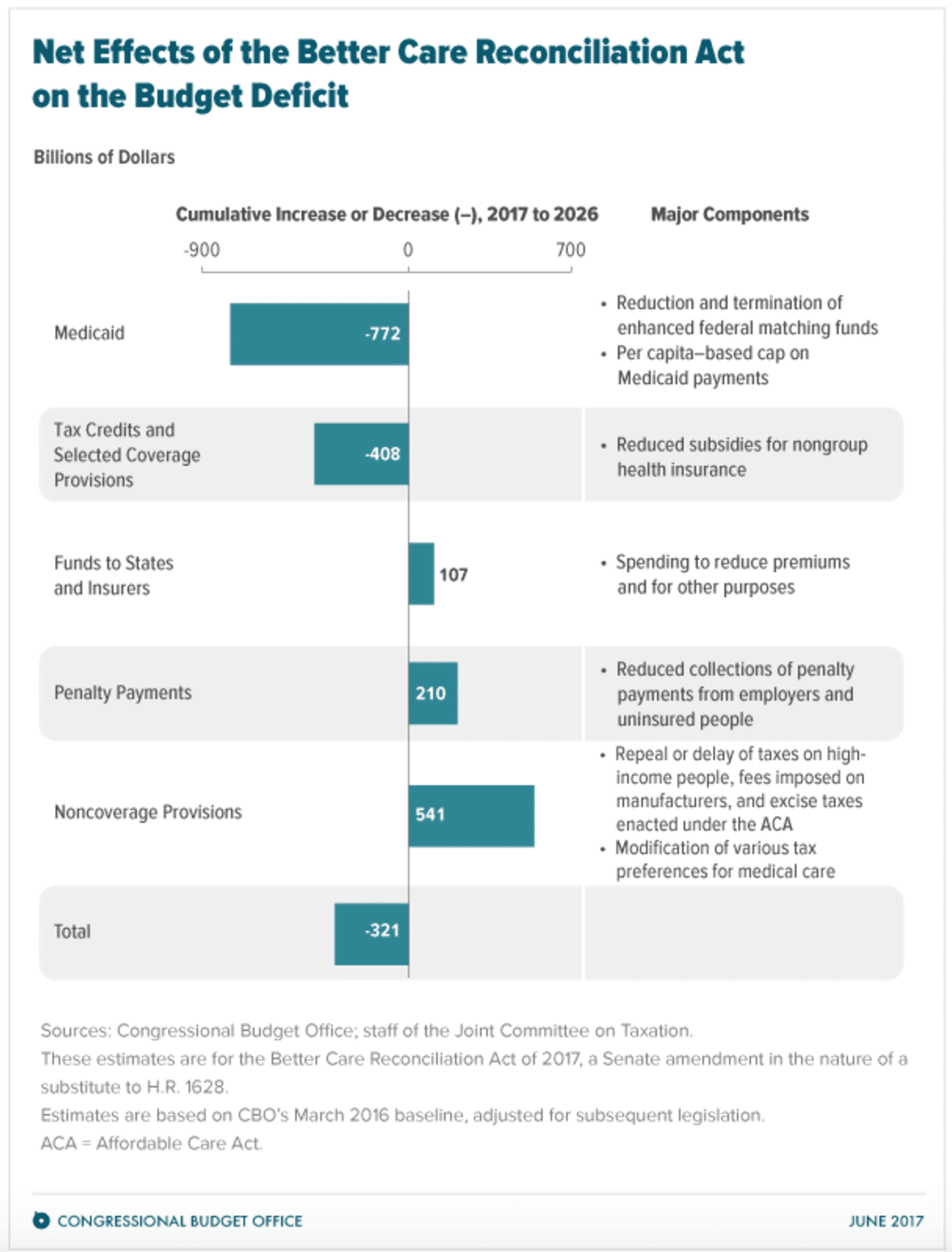

The Congressional Budget Office and the staff of the Joint Committee on Taxation (JCT) have completed an estimate of the direct spending and revenue effects of the Better Care Reconciliation Act of 2017, a Senate amendment in the nature of a substitute to H.R. 1628. CBO and JCT estimate that enacting this legislation would reduce the cumulative federal deficit over the 2017-2026 period by $321 billion. That amount is $202 billion more than the estimated net savings for the version of H.R. 1628 that was passed by the House of Representatives.

The Senate bill would increase the number of people who are uninsured by 22 million in 2026 relative to the number under current law, slightly fewer than the increase in the number of uninsured estimated for the House-passed legislation. By 2026, an estimated 49 million people would be uninsured, compared with 28 million who would lack insurance that year under current law.

Following the overview, this document provides details about the major provisions of this legislation, the estimated costs to the federal government, the basis for the estimate, and other related information, including a comparison with CBO’s estimate for the House-passed act.

Effects on the Federal Budget

CBO and JCT estimate that, over the 2017-2026 period, enacting this legislation would reduce direct spending by $1,022 billion and reduce revenues by $701 billion, for a net reduction of $321 billion in the deficit over that period (see Table 1, at the end of this document):

- The largest savings would come from reductions in outlays for Medicaid—spending on the program would decline in 2026 by 26 percent in comparison with what CBO projects under current law—and from changes to the Affordable Care Act’s (ACA’s) subsidies for nongroup health insurance (see Figure 1). Those savings would be partially offset by the effects of other changes to the ACA’s provisions dealing with insurance coverage: additional spending designed to reduce premiums and a reduction in revenues from repealing penalties on employers who do not offer insurance and on people who do not purchase insurance.

- The largest increases in deficits would come from repealing or modifying tax provisions in the ACA that are not directly related to health insurance coverage, including repealing a surtax on net investment income and repealing annual fees imposed on health insurers.

Pay-as-you-go procedures apply because enacting this legislation would affect direct spending and revenues. CBO and JCT estimate that enactment would not increase net direct spending or on-budget deficits in any of the four consecutive 10-year periods beginning in 2027. The agencies expect that savings, particularly from Medicaid, would continue to grow, while the costs would be smaller because a rescinded tax on employees’ health insurance premiums and health plan benefits would be reinstated in 2026. CBO has not completed an estimate of the potential impact of this legislation on discretionary spending, which would be subject to future appropriation action.

Effects on Health Insurance Coverage

CBO and JCT estimate that, in 2018, 15 million more people would be uninsured under this legislation than under current law—primarily because the penalty for not having insurance would be eliminated. The increase in the number of uninsured people relative to the number projected under current law would reach 19 million in 2020 and 22 million in 2026. In later years, other changes in the legislation—lower spending on Medicaid and substantially smaller average subsidies for coverage in the nongroup market—would also lead to increases in the number of people without health insurance. By 2026, among people under age 65, enrollment in Medicaid would fall by about 16 percent and an estimated 49 million people would be uninsured, compared with 28 million who would lack insurance that year under current law.

Stability of the Health Insurance Market

Decisions about offering and purchasing health insurance depend on the stability of the health insurance market—that is, on the proportion of people living in areas with participating insurers and on the likelihood of premiums’ not rising in an unsustainable spiral. The market for insurance purchased individually with premiums not based on one’s health status would be unstable if, for example, the people who wanted to buy coverage at any offered price would have average health care expenditures so high that offering the insurance would be unprofitable.

Under Current Law. Although premiums have been rising under current law, most subsidized enrollees purchasing health insurance coverage in the nongroup market are largely insulated from increases in premiums because their out-of-pocket payments for premiums are based on a percentage of their income; the government pays the difference between that percentage and the premiums for a reference plan (which is the second-lowest-cost plan in their area providing specified benefits). The subsidies to purchase coverage, combined with the effects of the individual mandate, which requires most individuals to obtain insurance or pay a penalty, are anticipated to cause sufficient demand for insurance by enough people, including people with low health care expenditures, for the market to be stable in most areas.

Nevertheless, a small number of people live in areas of the country that have limited participation by insurers in the nongroup market under current law. Several factors may lead insurers to withdraw from the market—including lack of profitability and substantial uncertainty about enforcement of the individual mandate and about future payments of the cost-sharing subsidies to reduce out-of-pocket payments for people who enroll in nongroup coverage through the marketplaces established by the ACA.

Under This Legislation. CBO and JCT anticipate that, under this legislation, nongroup insurance markets would continue to be stable in most parts of the country. Although substantial uncertainty about the effects of the new law could lead some insurers to withdraw from or not enter the nongroup market in some states, several factors would bring about market stability in most states before 2020. In the agencies’ view, those key factors include the following: subsidies to purchase insurance, which would maintain sufficient demand for insurance by people with low health care expenditures; the appropriation of funds for cost-sharing subsidies, which would provide certainty about the availability of those funds; and additional federal funding provided to states and insurers, which would lower premiums by reducing the costs to insurers of people with high health care expenditures.

The agencies expect that the nongroup market in most areas of the country would continue to be stable in 2020 and later years as well, including in some states that obtain waivers that would not have otherwise done so. (Under current law and this legislation, states can apply for Section 1332 waivers to change the structure of subsidies for nongroup coverage; the specifications for essential health benefits [EHBs], which set the minimum standards for the benefits that insurance in the nongroup and small-group markets must cover; and other related provisions of law.) Substantial federal funding to directly reduce premiums would be available through 2021. Premium tax credits would continue to provide insulation from changes in premiums through 2021 and in later years. Those factors would help attract enough relatively healthy people for the market in most areas of the country to be stable, CBO and JCT anticipate. That stability in most areas would occur even though the premium tax credits would be smaller in most cases than under current law and subsidies to reduce cost sharing—the amount that consumers are required to pay out of pocket when they use health care services—would be eliminated starting in 2020.

In the agencies’ assessment, a small fraction of the population resides in areas in which—because of this legislation, at least for some of the years after 2019—no insurers would participate in the nongroup market or insurance would be offered only with very high premiums. Some sparsely populated areas might have no nongroup insurance offered because the reductions in subsidies would lead fewer people to decide to purchase insurance—and markets with few purchasers are less profitable for insurers. Insurance covering certain services would become more expensive—in some cases, extremely expensive—in some areas because the scope of the EHBs would be narrowed through waivers affecting close to half the population, CBO and JCT expect. In addition, the agencies anticipate that all insurance in the nongroup market would become very expensive for at least a short period of time for a small fraction of the population residing in areas in which states’ implementation of waivers with major changes caused market disruption.

Effects on Premiums and Out-of-Pocket Payments

The legislation would increase average premiums in the nongroup market prior to 2020 and lower average premiums thereafter, relative to projections under current law, CBO and JCT estimate. To arrive at those estimates, the agencies examined how the legislation would affect the premiums charged if people purchased a benchmark plan in the nongroup market.

In 2018 and 2019, under current law and under the legislation, the benchmark plan has an actuarial value of 70 percent—that is, the insurance pays about 70 percent of the total cost of covered benefits, on average. In the marketplaces, such coverage is known as a silver plan.

Under the Senate bill, average premiums for benchmark plans for single individuals would be about 20 percent higher in 2018 than under current law, mainly because the penalty for not having insurance would be eliminated, inducing fewer comparatively healthy people to sign up. Those premiums would be about 10 percent higher than under current law in 2019—less than in 2018 in part because funding provided by the bill to reduce premiums would affect pricing and because changes in the limits on how premiums can vary by age would result in a larger number of younger people paying lower premiums to purchase policies.

In 2020, average premiums for benchmark plans for single individuals would be about 30 percent lower than under current law. A combination of factors would lead to that decrease—most important, the smaller share of benefits paid for by the benchmark plans and federal funds provided to directly reduce premiums.

That share of services covered by insurance would be smaller because the benchmark plan under this legislation would have an actuarial value of 58 percent beginning in 2020. That value is slightly below the actuarial value of 60 percent for “bronze” plans currently offered in the marketplaces. Because of the ACA’s limits on out-of-pocket spending and prohibitions on annual and lifetime limits on payments for services within the EHBs, all plans must pay for most of the cost of high-cost services. To design a plan with an actuarial value of 60 percent or less and pay for those high-cost services, insurers must set high deductibles—that is, the amounts that people pay out of pocket for most types of health care services before insurance makes any contribution. Under current law for a single policyholder in 2017, the average deductible (for medical and drug expenses combined) is about $6,000 for a bronze plan and $3,600 for a silver plan. CBO and JCT expect that the benchmark plans under this legislation would have high deductibles similar to those for the bronze plans offered under current law. Premiums for a plan with an actuarial value of 58 percent are lower than they are for a plan with an actuarial value of 70 percent (the value for the reference plan under current law) largely because the insurance pays for a smaller average share of health care costs.

Although the average benchmark premium directly affects the amount of premium tax credits and is a key element in CBO’s analysis of the budgetary effects of the bill, it does not represent the effect of this legislation on the average premiums for all plans purchased. The differences in the actuarial value of plans purchased under this legislation and under current law would be greater starting in 2020—when, for example, under this bill, some people would pay more than the benchmark premium to purchase a silver plan, whereas, under current law, others would pay less than the benchmark premium to purchase a bronze plan.

Under this legislation, starting in 2020, the premium for a silver plan would typically be a relatively high percentage of income for low-income people. The deductible for a plan with an actuarial value of 58 percent would be a significantly higher percentage of income—also making such a plan unattractive, but for a different reason. As a result, despite being eligible for premium tax credits, few low-income people would purchase any plan, CBO and JCT estimate.

By 2026, average premiums for benchmark plans for single individuals in most of the country under this legislation would be about 20 percent lower than under current law, CBO and JCT estimate—a smaller decrease than in 2020 largely because federal funding to reduce premiums would have lessened. The estimates for both of those years encompass effects in different areas of the country that would be substantially higher and substantially lower than the average effect nationally, in part because of the effects of state waivers. Some small fraction of the population is not included in those estimates. CBO and JCT expect that those people would be in states using waivers in such a way that no benchmark plan would be defined. Hence, a comparison of benchmark premiums is not possible in such areas.

Some people enrolled in nongroup insurance would experience substantial increases in what they would spend on health care even though benchmark premiums would decline, on average, in 2020 and later years. Because nongroup insurance would pay for a smaller average share of benefits under this legislation, most people purchasing it would have higher out-of-pocket spending on health care than under current law. Out-of-pocket spending would also be affected for the people—close to half the population, CBO and JCT expect—living in states modifying the EHBs using waivers. People who used services or benefits no longer included in the EHBs would experience substantial increases in supplemental premiums or out-of-pocket spending on health care, or would choose to forgo the services. Moreover, the ACA’s ban on annual and lifetime limits on covered benefits would no longer apply to health benefits not defined as essential in a state. As a result, for some benefits that might be removed from a state’s definition of EHBs but that might not be excluded from insurance coverage altogether, some enrollees could see large increases in out-of-pocket spending because annual or lifetime limits would be allowed.

Uncertainty Surrounding the Estimates

CBO and JCT have endeavored to develop budgetary estimates that are in the middle of the distribution of potential outcomes. Such estimates are inherently inexact because the ways in which federal agencies, states, insurers, employers, individuals, doctors, hospitals, and other affected parties would respond to the changes made by this legislation are all difficult to predict. In particular, predicting the overall effects of the myriad ways that states could implement waivers is especially difficult.

CBO and JCT’s projections under current law itself are also uncertain. For example, enrollment in the marketplaces under current law will probably be lower than was projected under the March 2016 baseline used in this analysis, which would tend to decrease the budgetary savings from this legislation. However, the average subsidy per enrollee under current law will probably be higher than was projected in March 2016, which would tend to increase the budgetary savings from this legislation. (For a related discussion, see the section on “Use of the March 2016 Baseline” on page 15.)

Despite the uncertainty, the direction of certain effects of this legislation is clear. For example, the amount of federal revenues collected and the amount of spending on Medicaid would almost surely both be lower than under current law. And the number of uninsured people under this legislation would almost surely be greater than under current law.

Intergovernmental and Private-Sector Mandates

CBO has reviewed the nontax provisions of the legislation and determined that they would impose intergovernmental mandates as defined in the Unfunded Mandates Reform Act (UMRA) by preempting state laws. Although the preemptions would limit the application of state laws, they would impose no duty on states that would result in additional spending or a loss of revenues. JCT has determined that the tax provisions of the legislation contain no intergovernmental mandates.

JCT and CBO have determined that the legislation would impose private-sector mandates as defined in UMRA. On the basis of information from JCT, CBO estimates that the aggregate cost of the mandates would exceed the annual threshold established in UMRA for private-sector mandates ($156 million in 2017, adjusted annually for inflation).