Facing Up To Income Inequality

The Census Bureau recently announced a heartening 5 percent gain in the median household income between 2014 and 2015, the largest one-year gain on record. Yet a look at the longer-term trends offers a sobering perspective. The jump in household income merely helps to make up for lost ground; the median earnings in 2015 were actually lower than back in 1999 — 16 years ago.

While household median incomes have stagnated since the late 1990s, the inflation-adjusted earnings of poorer households have stagnated for even longer, roughly 40 years. Meanwhile, households at or near the top of the income distribution have enjoyed sizeable increases of living standards. The result is a stark widening of the gap between rich and poor households.

There is perhaps no issue in America more contentious than income inequality. Everybody has a theory as to why the gap between rich and poor has widened and what should be done — if anything — to close it. A full explanation should help us understand why the United States stands out for having an especially high and rising inequality of income.

There are three main factors at play: technology, trade, and politics. Technological innovations have raised the demand for highly trained workers, thereby pushing up the incomes of college-educated workers relative to high-school-educated workers. Global trade has exposed the wages of industrial workers to tough international competition from workers at much lower pay scales. And our federal politics has tended, during the past 35 years, to weaken the political role of the working class, diminish union bargaining power, and cap or cut the government benefits received by working-class families.

Consider technology. Throughout modern history, ingenious machines have been invented to replace heavy physical labor. This has been hugely beneficial: Most (though not all) American workers have been lucky to escape the hard toil, drudgery, dangers, and diseases of heavy farm work, mining, and heavy industry. Farm jobs have been lost, but with some exceptions, their backbreaking drudgery has been transformed into office jobs. Farm workers and miners combined now account for less than 1 percent of the labor force.

Yet the office jobs required more skills than the farm jobs that disappeared. The new office jobs needed a high school education, and, more recently, a college degree. So who benefited? Middle-class and upper-class kids fortunate enough to receive the education and skills for the new office jobs. And who lost? Mostly poorer kids who couldn’t afford the education to meet the rising demands for skilled work.

Now the race between education and technology has again heated up. The machines are getting smarter and better faster than ever before — indeed, faster than countless households can help their kids to stay in the job market. Sure, there are still good jobs available, as long as you’ve graduated with a degree in computer science from MIT, or at least a nod in that direction.

Globalization is closely related to technology and, indeed, is made possible by it. It has a similar effect, of squeezing incomes of lower-skilled workers. Not only are the assembly-line robots competing for American jobs; so too are the lower-waged workers half a world away from the United States. American workers in so-called “traded-goods” sectors, meaning the sectors in direct competition with imports, have therefore faced an additional whammy of intense downward pressure on wages.

For a long time, economists resisted the public’s concern about trade depressing wages of lower-skilled workers. Twenty-two years ago I coauthored a paper arguing that rising trade with China and other low-wage countries was squeezing the earnings of America’s lower-skilled workers. The paper was met with skepticism. A generation later, the economics profession has mostly come around to recognize that globalization is a culprit in the rise of income inequality. This doesn’t mean that global trade should be ended, since trade does indeed expand the overall economy. It does, however, suggest that open trade should be accompanied by policies to improve the lot of lower-wage, lower-skilled workers, especially those directly hit by global trade but also those indirectly affected.

Many analyses of rising income inequality stop at this point, emphasizing the twin roles of technology and trade, and perhaps debating their relative importance. Yet the third part of the story — the role of politics — is perhaps the most vital of all. Politics shows up in two ways. First, politics helps to determine the bargaining power of workers versus corporations: how the overall pie is divided between capital and labor. Second, politics determines whether the federal budget is used to spread the benefits of a rising economy to the workers and households left behind.

Unfortunately, US politics has tended to put the government’s muscle on behalf of big business and against the working class. Remember the Reagan revolution: tax cuts for the rich and the companies, and union-busting for the workers? Remember the Clinton program to “end welfare as we know it,” a program that pushed poor and working-class moms into long-distance commuting for desperately low wages, while their kids were often left back in dangerous and squalid conditions? Remember the case of the federal minimum wage, which has been kept so low for so long by Congress that its inflation-adjusted value peaked in 1968?

There is no deep mystery as to why federal politics has turned its back on the poor and working class. The political system has become “pay to play,” with federal election cycles now costing up to $10 billion, largely financed by the well-heeled class in the Hamptons and the C-suites of Wall Street and Big Oil, certainly not the little guy on unemployment benefits. As the insightful political scientist Martin Gilens has persuasively shown, when it comes to federal public policy, only the views of the rich actually have sway in Washington.

So in the end, the inequality of income in the United States is high and rising while in other countries facing the same technological and trade forces, the inequality remains lower, and the rise in inequality has tended to be less stark. What explains the difference in outcomes? In the other countries, democratic politics offers voice and representation to average voters rather than to the rich. Votes and voters matter more than dollars.

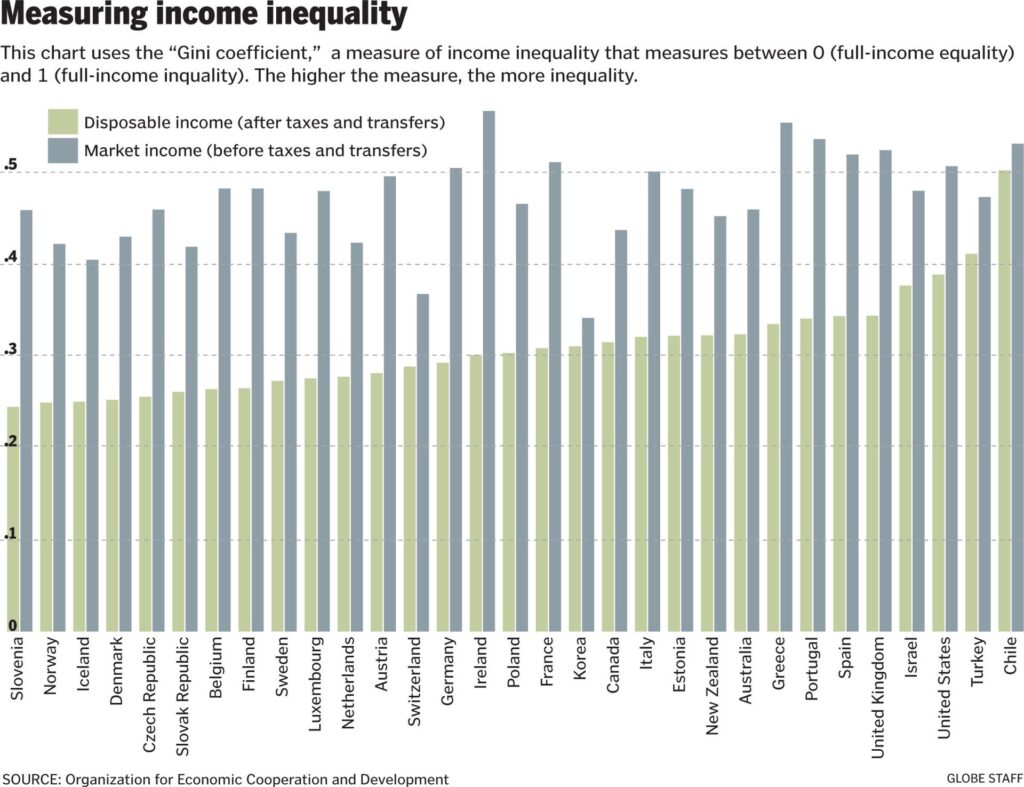

To delve more deeply into the comparison between the United States and other countries, it is useful to measure the inequality of income in each country in two different ways. The first way measures the inequality of “market incomes” of households, that is, the income of households measured before taxes and government benefits are taken into account. The second measures the inequality of “disposable income,” taking into account the taxes paid and transfers received by the household.

The difference between the two measures shows the extent of income redistribution achieved through government taxation and spending. In all of the high-income countries, the inequality of market income is greater than the inequality of disposable income. The taxes paid by the relatively rich and the transfers made to the relatively poor help to offset some of the inequality of the marketplace.

The accompanying chart offers just this comparison for the high-income countries. For each country, two measures of inequality based on the “Gini coefficient” are calculated. The Gini coefficient is a measure of income inequality that varies between 0 (full-income equality across households) and 1 (full-income inequality, in which one household has all of the income). Countries as a whole tend to have a Gini coefficient of disposable income somewhere between 0.25 (low inequality) and 0.60 (very high inequality).

In the figure, we see the two values of the Gini coefficient for each country: a higher value (more inequality) based on market income and a lower value (less inequality) based on disposable income (that is, after taxes and transfers). We can see that in every country, the tax-and-transfer system shifts at least some income from the rich to the poor, thereby pushing down the Gini coefficient. Yet the amount of net redistribution is very different in different countries, and is especially low in the United States.

Compare, for example, the United States and Denmark. In the United States, the Gini coefficient on market income is a very high 0.51, and on disposable income, 0.40, still quite high. In Denmark, by comparison, the Gini coefficient on market income is a bit lower than the United States, at 0.43. Yet Denmark’s Gini coefficient on disposable income is far lower, only 0.25. America’s tax-and-transfer system reduces the Gini coefficient by only 0.11. Denmark’s tax-and-transfer system reduces the Gini coefficient by 0.18, half-again as high as in the United States.

How does Denmark end up with so much lower inequality of disposable income from its budget policies? Denmark taxes more heavily than the United States and uses the greater tax revenue to provide free health care, child care, sick leave, maternity and paternity leave, guaranteed vacations, free university tuition, early childhood programs, and much more. Denmark taxes a hefty 51 percent of national income and provides a robust range of high-quality public services. The United States taxes a far lower 31 percent and offers a rickety social safety net. In the United States, people are left to sink or swim. Many sink.

So, many Americans would suspect, Denmark is miserable and being crushed by taxes, right? Well, not so right. Denmark actually comes out number 1 in the world happiness rankings, while the United States comes in 13th. Denmark’s life expectancy is also higher, its poverty lower, and its citizens’ trust in government and in each other vastly higher than the equivalent trust in the United States.

So herin lies a key lesson for the United States. America’s inequality of disposable income is the highest among the rich countries. America is paying a heavy price in lost well-being for its high and rising inequality of income, and for its failure to shift more benefits to the poor and working class.

We have become a country of huge distrust of government and of each other; we have become a country with a huge underclass of people who can’t afford their prescription drugs, tuition payments, or rents or mortgage payments. Despite a roughly threefold increase in national income per person over the past 50 years, Americans report to survey takers no higher level of happiness than they did back in 1960. The fraying of America’s social ties, the increased loneliness and distrust, eats away at the American dream and the American spirit. It’s even contributing to a rise in the death rates among middle-aged, white, non-Hispanic Americans, a shocking recent reversal of very long-term trends of rising longevity.

The current trends will tend to get even worse unless and until American politics changes direction. As I will describe in a later column, the coming generation of yet smarter machines and robots will claim additional jobs among the lower-skilled workers and those performing rote activities. Wages will be pushed lower except for those with higher training and skills. Capital owners (who will own the robots and the software systems to operate them) will reap large profits while many young people will be unable to find gainful employment. The advance in technology could thereby contribute to a further downward spiral in social cohesion.

That is, unless we decide to do things differently. Twenty-eight countries in the Organization for Economic Cooperation and Development have lower inequality of disposable income than the United States, even though these countries share the same technologies and compete in the same global marketplace as the United States. These income comparisons underscore that America’s high inequality is a choice, not an irreversible law of the modern world economy.