Representative Bernie Sanders vehemently opposed bailing out the nation’s Savings & Loan institutions. The entire Savings and Loan (S&L) crisis was a slow-moving financial disaster that came to a head between 1986 and 1995, failing nearly a third of the 3,234 savings and loan associations in the United States.[1]

“Key to the S&L crisis was a mismatch of regulations to market conditions, speculation, and moral hazard brought about by the combination of taxpayer guarantees along with deregulation, as well as outright corruption and fraud. The implementation of greatly slackened and broadened lending standards led desperate banks to take far too much risk balanced by far too little capital on hand.”[1]

In summary:[1]

- The S&L crisis was the build-up and extended deflation of a U.S. real-estate lending bubble from the 1980s to the early 1990s.

- The crisis culminated in the collapse of hundreds of savings & loan institutions and the insolvency of the Federal Savings and Loan Insurance Corporation, which cost taxpayers tens of billions of dollars and contributed to the 1990–91 recession.

- The roots of the S&L crisis lay in excessive lending, speculation, and risk-taking driven by the moral hazard created by deregulation and taxpayer bailout guarantees.

- Some S&Ls led to outright fraud among insiders. Some of these S&Ls knew of—and allowed—such fraudulent transactions.

- As a result of the S&L crisis, Congress passed the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA), which amounted to a vast revamp of S&L industry regulations.

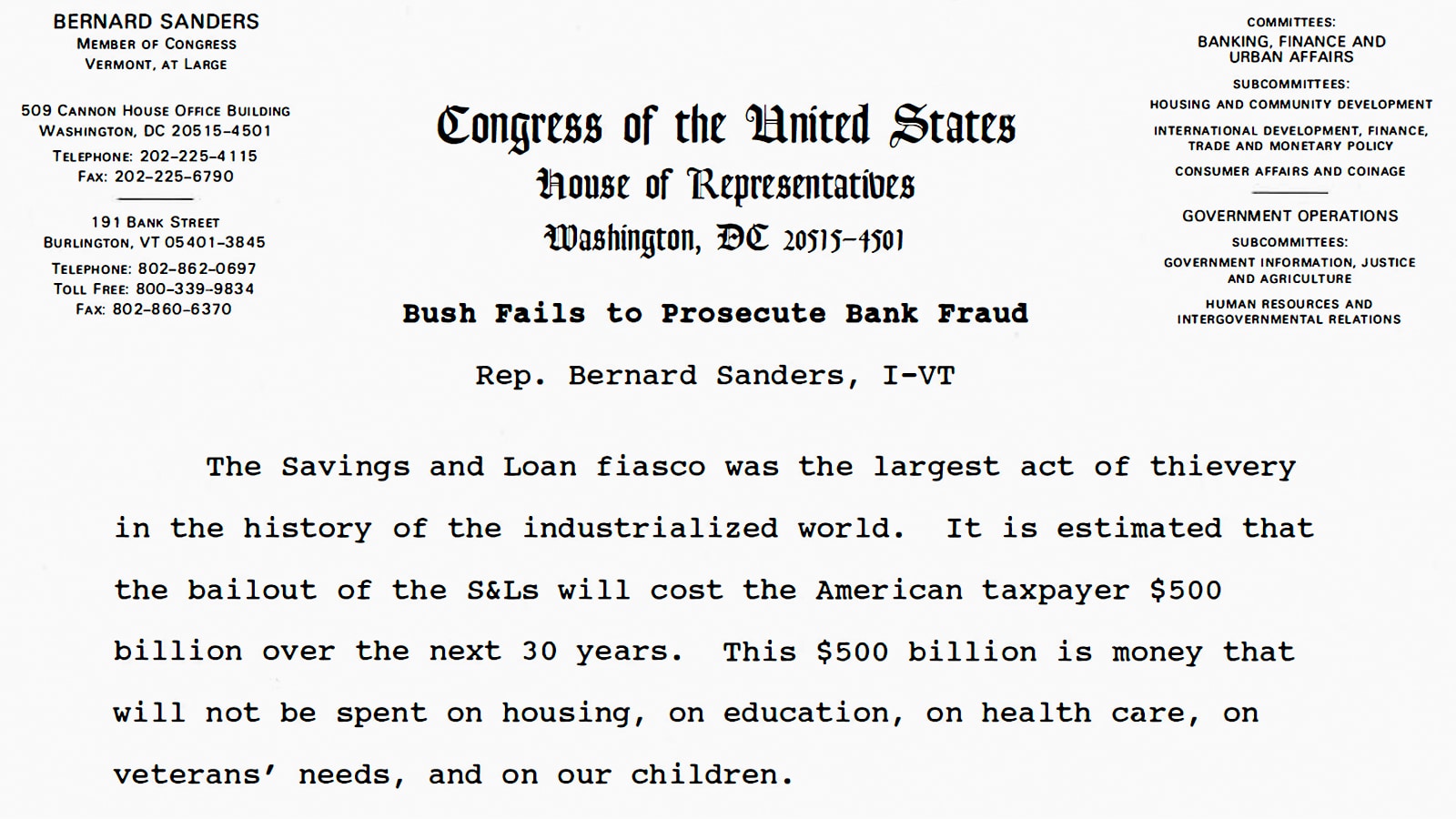

In a series of 1991 Congressional Op-Eds, Rep. Sanders, who also sat on the House Banking Committee, pledged not to vote for more S&L bailouts at the expense of the average American. Instead, he proposed, “Let those who profited pay part of their profits to cover the losses their financial shenanigans have created.”[2]

“The federal government bailed out the Savings & Loan banks to the tune of tens of billions of dollars, and less than a year later, the government had to add more tens of billions to bail the banks. The cost of the bailout is now at 50 billion dollars. Now President Bush is asking for tens of billions to bail out the savings and loans again. What’s going on?

“I sit on the House Banking Committee. If you listen to what they say in Washington, the situation is complicated. You know how economists talk: they use words and phrases that normal people can’t understand, and after they are done talking, they finally say one thing you understand. They hand you a bill and tell you how much the government will have to pay.”[2]

“Let’s look at the facts and at some very important developments which have just taken place. First of all, the General Accounting Office reports that there have been 2,676 bank and S&L failures since 1980. According to the FDIC, there are indications of suspected wrongdoing by directors, officers, and other professionals in 90 percent of the failed banks under their jurisdiction. And there is, in addition, suspected wrongdoing in 81 percent of all S&L failures.”[3]

“Has the Bush administration been vigorously prosecuting these bank managers and directors who engaged in fraud and mismanagement? The answer is an unequivocal NO. The Justice Department claims that in the top 100 major S&L referrals, out of 219 cases, there were 145 convictions and 90 sentences passed. But what really has been going on? While the top 100 Savings and Loans allegedly stole 597 million dollars and were ordered to pay restitution of $79 million, these top 100 S&Ls actually paid only $349,000 in restitution. And while the S&L officers were fined $4.5 million, they actually paid only $15,000 in fines.[3]

“As of February, less than half of one percent of the fines and restitutions ordered by the courts were ever collected from the top 100 thrifts! And of all 218 S&Ls that failed in the first four months of 1989, only 4% of all the fines and restitutions ordered by the courts were actually paid.”[3]

The Bush administration’s response to the ongoing crisis was to remove experienced lawyers from managing the fraud and reimbursement cases – leaving inexperienced lawyers to manage the cases.

“The Bush administration’s decision to gut the legal staff of the RTC means that working and middle-income people will be required to take on most of the burden of paying to bail out the S&Ls. Those who caused the mess will escape with little responsibility or liability.”[3]

“The Bush administration’s approach to this crisis staggers the imagination. The President wants to deregulate the commercial banks. What is remarkable about this proposal is that the deregulation of the Savings & Loan industry led directly to the huge number of bankrupt savings and loans, which in turn has meant a minimum $500 billion dollar catastrophe for the American taxpayer. The Bush administration also wants to put in place policies–interstate banking and branching, merging banks with insurance companies and industrial conglomerates, allowing banks to sell stocks–which will guarantee that a small number of giant banking cartels will control virtually all banking in the United States. This will result in a concentration of economic wealth and power the likes of which this country has never seen.”[4]

Back to Timeline

Back to Timeline