Congressional Budget Office Cost Estimate: The Tax Cuts And Jobs Act

The Reconciliation Recommendations of the Senate Committee on Finance, the Tax Cuts and Jobs Act, would amend numerous provisions of U.S. tax law. Among other changes, the bill would reduce most income tax rates for individuals and modify the tax brackets for those taxpayers; increase the standard deduction and the child tax credit; and repeal deductions for personal exemptions, certain itemized deductions, and the alternative minimum tax (AMT).

Those changes would take effect on January 1, 2018, and would be scheduled to expire after December 31, 2025. The bill also would permanently repeal the penalties associated with the requirement that most people obtain health insurance coverage (also known as the individual mandate).

The legislation would permanently modify business taxation as well. Among other provisions, beginning in 2019, it would replace the structure of corporate income tax rates, which has a top rate of 35 percent under current law, with a single 20 percent rate. The legislation also would substantially alter the current system under which the worldwide income of U.S. corporations is subject to taxation.

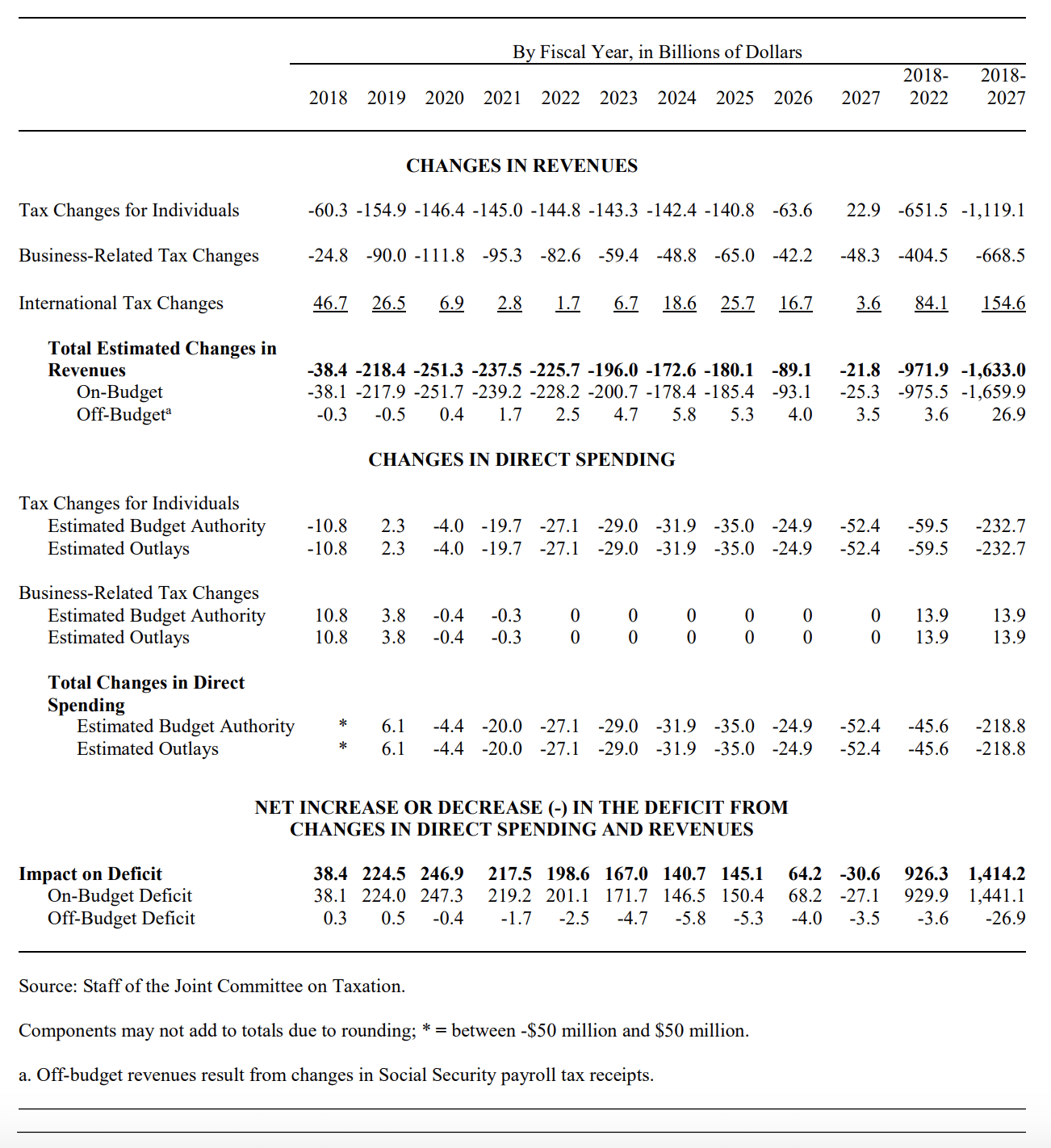

The staff of the Joint Committee on Taxation (JCT) estimates that enacting the legislation would reduce revenues by about $1,633 billion and decrease outlays by $219 billion over the 2018-2027 period, leading to an increase in the deficit of $1,414 billion over the next 10 years. A portion of the changes in revenues would be from Social Security payroll taxes, which are off-budget. Excluding the estimated $27 billion increase in off-budget revenues over the next 10 years, JCT estimates that the legislation would increase on-budget deficits by about $1,441 billion over the period from 2018 to 2027. Pay-as-you-go procedures apply because enacting the legislation would affect direct spending and revenues.

JCT estimates that enacting the legislation would not increase on-budget deficits by more than $5 billion in any of the four consecutive 10-year periods beginning in 2028.

Because of the magnitude of its estimated budgetary effects, the Tax Cuts and Jobs Act is considered major legislation as defined in section 4107 of H. Con. Res. 71, the Concurrent Resolution on the Budget for Fiscal Year 2018. It therefore triggers the requirement that the cost estimate, to the greatest extent practicable, include the budgetary impact of the bill’s macroeconomic effects. The staff of the Joint Committee on Taxation is currently analyzing changes in economic output, employment, capital stock, and other macroeconomic variables resulting from the bill for purposes of determining these budgetary effects. However, JCT indicates that it is not practicable for a macroeconomic analysis to incorporate the full effects of all of the provisions in the bill, including interactions between these provisions, within the very short time available between completion of the bill and the filing of the committee report.

CBO and JCT have determined that the tax provisions of the legislation contain no intergovernmental or private-sector mandates as defined in the Unfunded Mandates Reform Act (UMRA).

ESTIMATED COST TO THE FEDERAL GOVERNMENT

The estimated budgetary effects of the Tax Cuts and Jobs Act are shown in the table below.

BASIS OF ESTIMATE

Revenues and Direct Spending

The Congressional Budget Act of 1974, as amended, stipulates that JCT’s estimates of revenues will be the official estimates for all tax legislation considered by the Congress. Therefore, CBO incorporates JCT’s estimates into its cost estimates of the effects of legislation. JCT provided virtually all estimates for the provisions of the bill, but JCT and CBO collaborated on the estimate of the provision that would eliminate the penalties associated with the requirement that most people obtain health insurance coverage.1 The date of enactment of the bill is generally assumed to be December 1, 2017.

JCT estimates that, together, the provisions contained in the legislation would decrease federal revenues, on net, by about $38 billion in 2018, by $972 billion over the period from 2018 to 2022, and by $1,633 billion over the period from 2018 to 2027. Net outlays would be nearly unchanged in 2018, and would decrease by $46 billion from 2018 to 2022, and by $219 billion over the period from 2018 to 2027. On net, deficits would increase by $38 billion in 2018, by $926 billion from 2018 to 2022, and by $1,414 billion from 2018 to 2027. A portion of those effects reflect changes to revenues from Social Security taxes, which are off-budget. JCT estimates that over the 2018-2027 period, the bill would increase on-budget deficits by $1,441 billion and reduce off-budget deficits by $27 billion.

Tax Changes for Individuals. The bill would make numerous changes to tax law pertaining to individuals.

JCT estimates that the individual tax provisions would, on net, reduce revenues by $1,119 billion from 2018 to 2027. Those provisions also would decrease outlays by an estimated $233 billion over the 2018-2027 period. Some provisions would increase off-budget revenues by $20 billion over the period from 2018 to 2027, JCT estimates. On-budget revenues would decrease by an estimated $1,139 billion.

Revenue-Reducing Provisions. Provisions that are estimated to reduce revenues over the 2018-2027 period include the following, which would take effect on January 1, 2018 and expire on December 31, 2025:

- Modify the seven tax brackets in place under current law to create brackets with rates of 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 38.5 percent;

- Increase the standard deduction;

- Repeal the individual AMT (Alternative Minimum Tax);

- Allow a 17.4 percent deduction, subject to certain limits, for qualified business income that individuals receive from pass-through entities, namely partnerships, S corporations, and sole proprietorships;

- Increase the child tax credit to $2,000, and, among other related changes, provide a new $500 credit for certain other dependents; and

- Double the exemption allowed under estate and gift taxes.

According to JCT’s estimates, the largest revenue reductions would result from the provision that would modify income tax rates and brackets: Revenues would fall by $1,165 billion and outlays for refundable tax credits would increase by $9 billion over the 2018-2027 period. The increase in the standard deduction would reduce revenues by $654 billion and increase outlays for refundable tax credits by $83 billion over the same period, JCT estimates. Repealing the individual AMT would reduce revenues by $769 billion from 2018 to 2027.

JCT also estimates that the bill’s provisions that provide a deduction for qualifying income from pass-through entities would reduce revenues by $362 billion over the 2018-2027 period and that modifications to the child tax credit would, over the same period, reduce revenues by $431 billion and increase outlays for refundable tax credits by $154 billion. JCT estimates that additional revenue reductions, totaling $83 billion from 2018 to 2027, would result from the modifications to estate and gift taxes.

Revenue-Increasing Provisions. Provisions that are estimated to increase revenues over the 2018-2027 period would:

- Repeal deductions for personal exemptions through 2025;

- Repeal certain itemized deductions, including those for state and local taxes and interest on home equity indebtedness, also through 2025;

- Disallow immediate use of certain losses by active owners of pass-through entities; and

- Permanently index tax parameters to the chained consumer price index instead of the traditional consumer price index.

The largest revenue increases would result from the provision to repeal deductions for personal exemptions, which JCT estimates would increase revenues by $1,086 billion and reduce outlays for refundable credits by $134 billion over the 2018-2027 period. JCT estimates that the repeal of certain itemized deductions also would increase revenues by $974 billion and reduce outlays for refundable credits by $3 billion from 2018 to 2027.

Substantial but smaller increases in revenues would result from two other provisions. First, disallowing certain losses by pass-through entities would increase revenues by an estimated $137 billion over the 2018-2027 period. Second, the change in the inflation measure used to index tax parameters would increase revenues by $115 billion and reduce outlays for refundable credits by $19 billion over the 2018-2027 period, according to JCT’s estimates.

Repealing the Individual Mandate. The bill’s most significant effects on outlays would occur as a result of the elimination, beginning in 2019, of the penalties associated with the individual mandate. CBO and JCT estimate the following effects of that provision:

- Federal budget deficits would be reduced by about $318 billion between 2018 and 2027, consisting of estimated reductions in outlays of $298 billion and increases in revenues of $21 billion over the period;

- The number of people with health insurance would decrease by 4 million in 2019 and 13 million in 2027;

- Nongroup insurance markets would continue to be stable in almost all areas of the country throughout the coming decade; and

- Average premiums in the nongroup market would increase by about 10 percent in most years of the decade (with no changes in the ages of people purchasing insurance accounted for) relative to CBO’s baseline projections. In other words, premiums in both 2019 and 2027 would be about 10 percent higher than is projected in the baseline.

Those effects would occur mainly because healthier people would be less likely to obtain insurance and because, especially in the nongroup market, the resulting increases in premiums would cause more people to not purchase insurance. In this estimate for the Tax Cuts and Jobs Act, the estimated reduction in the deficit is different from a CBO and JCT estimate published on November 8, 2017.2 The differences occur because the provision of this legislation eliminates the penalties associated with the mandate but not the mandate itself and because of interactions with other provisions of the bill.

Business-Related Tax Changes. The bill would make many permanent changes to business taxes. The provisions with the largest effects on revenues, as estimated by JCT, are those that would:

- Replace, starting in 2019, the current graduated structure of corporate income tax rates, which has a top rate of 35 percent under current law, with a single 20 percent rate;

- Limit the deduction for net interest expenses to the sum of business interest income and 30 percent of an adjusted measure of taxable income; and

- Limit the deduction for past net operating losses to a portion of current taxable income, and generally repeal the two-year period over which losses may be carried back to previous tax years.

JCT estimates that those tax provisions would, on net, reduce revenues by $669 billion from 2018 to 2027. In addition, those provisions would increase outlays for refundable tax credits by an estimated $14 billion over the 2018-2027 period.

JCT estimates that the modifications to the rate structure, including reducing the top corporate tax rate from the 35 percent that is assessed on most taxable income to a 20 percent rate that would apply to all amounts of taxable income, would reduce revenues by $1,329 billion over the 2018-2027 period. JCT also estimates that limiting the deductions for interest expenses would increase revenues by $308 billion and that limiting the use of net operating losses would raise revenues by $158 billion over the same period.

The outlay effects from the business provisions would result from repealing the corporate alternative minimum tax. That change would reduce receipts by $26 billion and increase outlays by $14 billion over the period from 2018 to 2027, according to JCT’s estimates.

International Tax Changes. The bill would substantially modify the current system of taxation of worldwide income of U.S. corporations, generally including foreign earnings in taxable income when paid to businesses as dividends by their foreign subsidiaries and with an allowance for tax credits for certain foreign taxes that businesses pay. Under the Tax Cuts and Jobs Act, the tax system would provide an exemption for dividends paid by a foreign corporation to its U.S. parent, and no foreign tax credits would be allowed for taxes paid on the amount of such dividends. Other changes also would be implemented. The international tax provisions with the largest estimated effects on revenues are those that would:

- Provide a deduction for the foreign-source portion of dividends received by domestic corporations from certain foreign corporations;

- Require that certain untaxed foreign income of U.S. corporations be deemed to be immediately paid to those corporations as dividends and included in taxable income, subject to taxation at a rate of 10 percent (or 5 percent for certain illiquid assets), and with an option to spread the resulting tax payments over an eight-year period with 60 percent paid in the final three years;

- Impose on U.S. corporations a minimum tax of 10 percent (12.5 percent starting in 2026) on a tax base that excludes certain otherwise tax-deductible payments to foreign affiliates; and

- Require that U.S. corporations immediately include in taxable income certain amounts earned from low-taxed investments by foreign subsidiaries.

JCT estimates that the provisions related to international taxation would, on net, increase revenues by $155 billion from 2018 to 2027. It also estimates that the deduction for dividends received from foreign corporations would reduce revenues by $216 billion over that period. JCT estimates that three other provisions would have large budgetary effects that would increase revenues from 2018 to 2027. Those provisions would require a deemed repatriation of untaxed foreign income ($185 billion), impose a new minimum tax ($138 billion), and require the immediate inclusion in taxable income of certain amounts earned by foreign subsidiaries ($135 billion).

Revenue-Dependent Repeals. The bill would make parts of six business and international taxation provisions dependent on future revenue collections. The parts that would be affected generally begin in 2026, and would increase revenues in 2026 and 2027. Those amounts are incorporated into the overall revenue effects shown in the estimate of this legislation. The provisions include those that would require that certain research or experimental expenditures be amortized, that would limit the deduction for net operating losses, and that would impose a minimum tax on a tax base that excludes certain otherwise tax-deductible payments to foreign affiliates.

Under the legislation, the parts of those provisions beginning in 2026 would not take effect if an overall revenue target was reached. Specifically, if on-budget revenues for the period from 2018 to 2026 exceeded $28.387 trillion, then those revenue-raising provisions would be repealed starting in 2026. Under CBO’s latest baseline revenue projections, adjusted to include the revenue effects of the bill (without incorporating any macroeconomic feedback), the on-budget revenue target would not be reached and therefore the revenue-raising modifications would occur. JCT has estimated that the revenue-dependent repeals would have a negligible effect on revenues. Given variations in inflation, economic output, and many other economic developments that affect revenues, including the response of overall economic activity to this legislation, there is some probability that the target would be reached and that the modifications to those provisions, and the resulting revenues, would not occur.

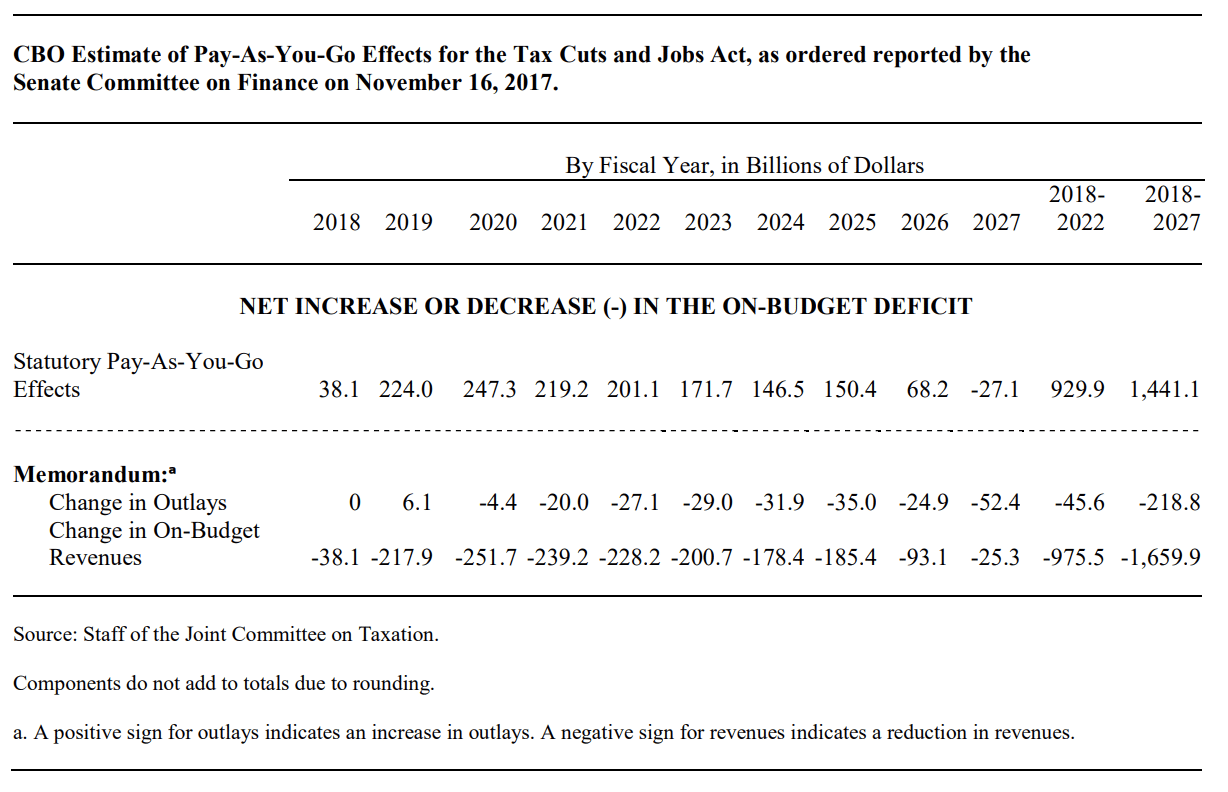

PAY-AS-YOU-GO-CONSIDERATIONS

The Statutory Pay-As-You-Go Act of 2010 establishes budget-reporting and enforcement procedures for legislation affecting direct spending or revenues. The net changes in outlays and revenues that are subject to those pay-as-you-go procedures are shown in the following table. Only on-budget changes to outlays or revenues are subject to pay-as-you-go procedures.

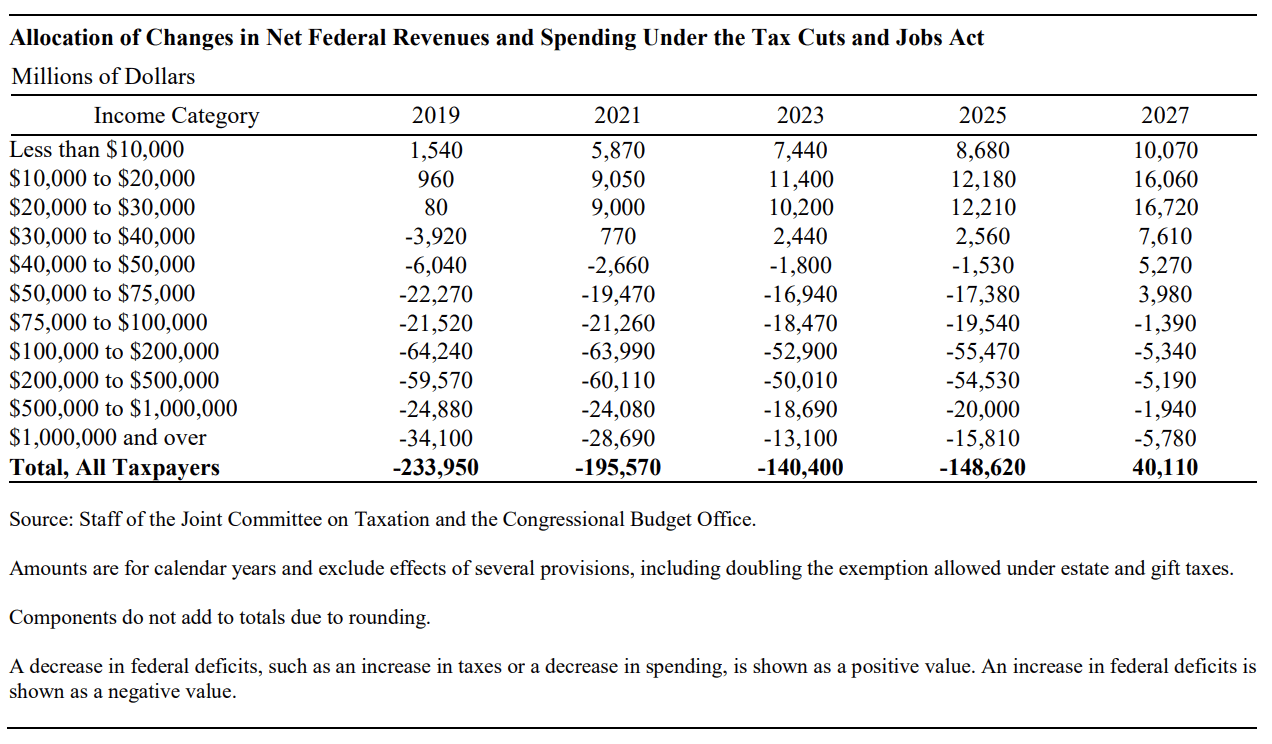

ALLOCATION OF BUDGETARY EFFECTS ACROSS INCOME GROUPS

Section 4107 of H. Con. Res. 71 requires that CBO and JCT’s estimates of budgetary effects for major legislation include, to the extent practicable, the legislation’s distributional effects across income categories.

JCT has published a distributional analysis of the Tax Cuts and Jobs Act that includes the effects of the bill on revenues and on the portion of refundable tax credits recorded as outlays.3 That analysis included effects on outlays for premium tax credits stemming from eliminating the penalty associated with the requirement that most people obtain health insurance coverage. However, other spending related to eliminating that penalty was not included, specifically changes in spending for Medicaid, cost-sharing reduction payments, the Basic Health Program, and Medicare.

CBO has separately allocated across income groups the budgetary effects of those other changes for an earlier version of the legislation, under consideration by the Senate Finance Committee; those estimates also apply to the bill as ordered reported.4 In making those estimates, CBO did not attempt to estimate the value that people place on such spending, which may be different from the actual cost to the government of providing the benefits. CBO also did not attempt to make any distributional allocations for people who would choose to obtain unsubsidized health insurance in the nongroup market and who face higher premiums there compared with what would occur otherwise.

The combined distributional effect of the provisions estimated by JCT and CBO, thus representing the total distributional effect of the bill, was calculated by subtracting the estimated change in federal spending from the change in federal revenues allocated to each income group. The resulting changes in the federal deficit allocated to each income group are reflected in the following table.

Overall, the combined effect of the change in net federal revenues and spending is to decrease deficits (primarily stemming from reductions in spending) allocated to lower-income tax filing units and to increase deficits (primarily stemming from reductions in taxes) allocated to higher-income tax filing units. Those effects do not incorporate any estimates of the budgetary effects of any macroeconomic changes that would stem from the proposal.

INCREASE IN LONG-TERM ON-BUDGET DEFICITS

JCT estimates that enacting the legislation would not increase on-budget deficits by more than $5 billion in any of the four consecutive 10-year periods beginning in 2028.

MANDATES

CBO and JCT have determined that the legislation contains no intergovernmental or private-sector mandates as defined by UMRA.