Paying For A Zero-Emissions Economy

In October 2018, the Intergovernmental Panel on Climate Change (IPCC), the most authoritative global organization advancing climate change research, issued an alarming report titled “Global Warming of 1.5°C.” This report emphasized the imperative of limiting the increase in global mean temperatures to 1.5 degrees Celsius above pre-industrial levels as opposed to 2.0 degrees, the previous consensus goal.

The IPCC concluded that limiting the global mean temperature increase to 1.5 rather than 2.0 degrees by 2100 will dramatically lower the likely negative consequences of climate change. These include the risks of heat extremes, heavy precipitation, droughts, sea level rise, biodiversity losses, and corresponding impacts on health, livelihoods, food security, water supply, and human security.

The IPCC estimates that to achieve the 1.5 degrees maximum global mean temperature increase target as of 2100, global net CO2 emissions will have to fall by about 45 percent as of 2030 and reach net-zero emissions by 2050. I focus in this article on what it will take for the U.S. economy to reach net-zero CO2 emissions by 2050, and specifically, how we can pay for this project. In the interests of space, I do not delve into the additional specific financing challenges around also hitting the IPCC’s intermediate target of a 45 percent CO2 emissions reduction by 2030, though important additional challenges do emerge with achieving this 2030 goal.

Purely in terms of the financing issues involved, it is an entirely reasonable and not especially difficult proposition to build a zero-emissions U.S. economy by 2050. By my higher-end estimate, it will require an average level of investment spending throughout the U.S. economy of about 2 percent of GDP per year, focused in two areas: (1) dramatically improving energy efficiency standards in the stock of buildings, automobiles, and public-transportation systems, and in industrial production processes; and (2) equally dramatically expanding the supply of clean renewable-energy sources—primarily wind, solar, and geothermal power—available at competitive prices to all sectors of the U.S. economy.

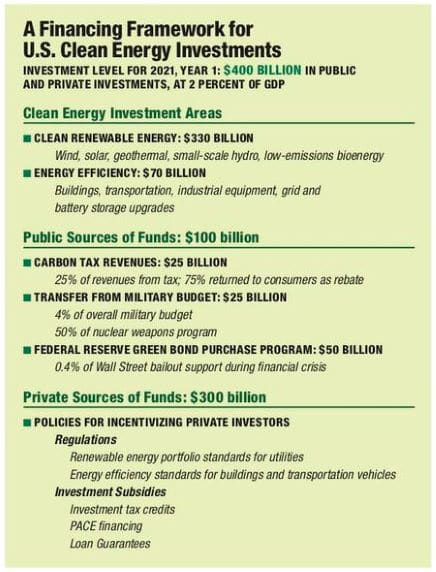

This level of clean-energy investment spending would amount to about $400 billion in the first year of the program, which I will set as 2021, and rise to about $850 billion as of 2050, assuming the economy grows at an average rate of about 2.4 percent per year. As an average figure between 2021 and 2030, investment spending would then be around $600 billion per year. Total clean-energy investment spending for the 30-year period would amount to about $18 trillion.

These figures are for overall investment spending, including from both the public and private sectors. Establishing the right mix between public and private investment will be a major consideration. As an initial rough approximation, let’s assume that the breakdown should be 25 percent public and 75 percent private investment. For the first year of the project in 2021, this would break down to $100 billion in public investments along with $300 billion in private funds. A major part of the policy challenge will be to determine how to leverage the public money most effectively to create strong incentives for private investors.

Before plunging into the financing details, I need to emphasize a critical point at the outset: This clean-energy investment project will pay for itself in full over time because it will deliver lower energy costs for all U.S. energy consumers. This results because raising energy efficiency standards means that, by definition, consumers will spend less for a given amount of energy services, such as being able to travel 100 miles on a gallon of gasoline with a high-efficiency hybrid plug-in vehicle as opposed to 25 miles per gallon with the average car on U.S. roads today. Moreover, the costs of supplying energy through wind, solar, geothermal, and hydro power are now, on average, roughly equal to or lower than those for fossil fuels and nuclear energy. As such, the initial up-front investment outlays can be repaid over time through the cost savings that will be forthcoming.

In addition to building a clean-energy infrastructure, this new investment will be a major new source of job creation at all levels of the U.S. labor market—in the range of 7.5 million jobs on average between 2021 and 2050. This is true, even while recognizing that the workers and communities in the U.S. whose livelihoods depend on the fossil fuel industry will inevitably be hurt as this industry contracts, step-by-step, to zero between now and 2050. Advancing generous “just transition” policies for the affected workers and communities needs to be a central element of the overall clean-energy investment project. Harold Meyerson discusses these critical questions around job creation and just transition policies elsewhere in this issue.

For 2018, clean-energy investments in the U.S. economy amounted to about $64 billion, equal to about 0.3 percent of GDP. We therefore need to expand clean-energy investments roughly sixfold in very short order to get to the 2 percent of GDP target, and then maintain this heightened level of spending relative to GDP until 2050. At one level, this is obviously a daunting challenge. On the other hand, it does still mean that roughly 98 percent of economic activity in the U.S. can proceed largely independent of the clean-energy investment project.

Why 2 Percent of GDP?

To show that my spending estimates are not based on a lot of hocus-pocus, I should describe where the 2 percent of GDP figure comes from. This estimate is derived directly from the figures on costs in the U.S. to achieve either a given improvement in energy efficiency or a given increase in the clean renewable energy supply.

The U.S. economy presently consumes a total of about 100 quadrillion British thermal units (Q-BTUs) of energy from all fossil fuel, nuclear, and renewable-energy sources. As a high-end estimate, working from the research literature, I assume that it will cost about $30 billion to achieve 1 Q-BTU of energy savings relative to the consumption level that would result through a business-as-usual economic trajectory between now and 2050. From this, I calculate that it will cost a total of about $3.3 trillion over the 30-year investment cycle, or about $100 billion per year on average, to stabilize overall U.S. energy consumption at about 110 Q-BTUs as of 2050. For Year 1, energy efficiency investments would be about $70 billion.

To operate the U.S. economy totally through clean-energy sources as of 2050, that means that we need a total of 110 Q-BTUs of clean-energy supply. At present, total supply of wind, solar, hydro, and geothermal is about 6 Q-BTUs. We therefore need to expand supply by 104 Q-BTUs by 2050. Again, working from the research literature, a high-end figure for the average costs of expanding renewable-energy supply between 2021 and 2050 is about $150 billion per Q-BTU. Thus, over the 30-year investment cycle, we need to spend a total of roughly $14.6 trillion on clean-energy capital expenditures, or a bit less than $500 billion per year on average. For Year 1, the spending level would be about $330 billion.

The total average investment spending level will therefore need to be about $600 billion per year, with $500 billion going to renewable investments and $100 billion to efficiency projects. Average GDP between 2021 and 2050 will be about $30 trillion if the U.S. economy grows at 2.4 percent per year. This is how we reach the conclusion that clean-energy investments will need to average about 2 percent of GDP per year between 2021 and 2050—i.e., $600 billion in investments divided by $30 trillion in GDP.

As noted above, we are assuming that of the full $400 billion in spending that will be required in Year 1, $100 billion will come from the federal government, with the remaining $300 billion supplied by private investors. We also assume that the $300 billion in private investment funding will not be forthcoming without strong and large-scale public-policy interventions. We therefore need to answer two big questions with a financing proposal: where to get $100 billion a year in new federal government funds, and how to most effectively induce the additional $300 billion in private funds? The table, right, provides a guide for following the main features of my proposed plan.

Where to Get $100 Billion in Federal Government Money?

As of 2018, the U.S. federal government budget was $4.1 trillion. The $100 billion budget for federal clean-energy investments that I am proposing would therefore amount to only 2.5 percent of the overall budget. Nevertheless, these funds will need to come from someplace. I propose three funding sources: (1) a carbon tax, in which 75 percent of revenues are rebated back to the public but 25 percent are channeled into clean-energy investment projects; (2) transferring funds out of the military budget, particularly from its nuclear weapons program; and (3) a Federal Reserve–based Green Bond lending program. Strong cases can be made for each of these funding measures. But each proposal does also have vulnerabilities, including around political feasibility. The most sensible approach is therefore to combine the measures into a single package that minimizes their respective weaknesses as stand-alone initiatives.

Carbon Tax With Rebates. As noted by James Boyce elsewhere in this issue, carbon taxes have the merit of impacting climate policy through two channels—they raise fossil fuel prices and thereby discourage consumption while also generating a new source of government revenue. At least part of the carbon tax revenue can then be channeled into supporting the clean-energy investment project. But the carbon tax will hit low- and middle-income people disproportionately, since they spend a larger fraction of their income on electricity, gasoline, and home-heating fuel. An equal-shares rebate, as proposed by Boyce, is the simplest way to ensure that the full impact of the tax will be equalized across the population.

Consider, therefore, the following tax-and-rebate program. Focusing, again, on Year 1, we begin the tax at a low rate of $20 per ton of carbon. Given current U.S. CO2 emissions levels, that would generate about $100 billion in revenue. If we use only 25 percent of this revenue to finance clean-energy investments, that amounts to $25 billion for investment projects. This would then cover about 25 percent of the $100 billion in total federal funding needed for the clean-energy investment project. The 75 percent of the total revenue that is rebated to the public in equal shares would amount to about $230 for every U.S. resident, or nearly $1,000 for a family of four. The average price of gasoline would rise by about 7 percent, from about $2.70 to $2.90 per gallon.

Taking From U.S. Military Budget. The U.S. military budget in 2018 was about $700 billion. We would therefore need to devote about 14 percent of the military budget to clean-energy transformation to fully fund the $100 billion in total federal funding for the clean-energy investment project. This would be an entirely justifiable transfer of funds on both logical and ethical grounds if we take at face value the idea that U.S. defense spending should be about protecting the well-being of U.S. citizens. But, on political grounds, it would represent an implausibly large military spending cut. A more realistic approach would be to allow that the transfer out of the military budget would, like the carbon tax funds, be at $25 billion. This would require a transfer of about 4 percent out of the military budget. These funds could be raised through a 4 percent across-the-board military spending cut. A more targeted approach would be to cut by cut by 50 percent the average annual $50 billion budget now devoted to nuclear weapons development. Given that, along with climate change, the existence of nuclear weapons represents a true existential threat to life on Earth, this would be a fitting approach to funding the clean-energy investment project.

Federal Reserve Green Bond Funding. It was demonstrated during the 2007–2009 financial crisis and subsequent Great Recession that the Federal Reserve is willing and able to supply basically unlimited bailout funds to Wall Street during crises. The extensive 2017 study “The Cost of the Crisis” by Better Markets documents this carefully:

Within the first few years following the onset of the crisis, the government committed approximately $12.2 trillion to stop the crash of the financial system, stabilize the economy, and try to spur economic growth. Of that massive total, $9 trillion was allocated to bailing out Wall Street’s too-big-to-fail banks with direct investments in financial institutions, purchases of high-grade corporate debt, and purchases of mortgage-backed securities; $1.7 trillion was allocated to insuring debt issued by financial institutions and guaranteeing poorly performing assets; and $1.4 trillion went to a significant expansion of the government’s traditional overnight lending to banks.

What also became clear through these bailout operations is that there were no binding rules prohibiting the Fed from intervening in the private financial market in any ways it deemed appropriate.

I would propose $50 billion in Green Bond financing supplied by the Fed, which would then match the $25 billion each coming from both the carbon tax and military budget transfers. This would amount to a minuscule 0.4 percent of the Fed’s Wall Street bailout operations during the crisis. It is true that the Wall Street bailouts during the crisis represented a dramatic deviation from normal Fed operating practices, induced by the incipient global financial collapse. But it is also obviously true that we human beings now face a far more dire crisis resulting from climate change.

The Fed’s funding support could be injected into the economy through straightforward channels. That is, federal, state, and municipal governments could issue long-term zero-interest-rate Green Bonds. The Federal Reserve would purchase these bonds. The various levels of government would then have the funds to pursue the full range of projects that will fall under the rubric of the $100 billion in public funds needed to finance the clean-energy investment project.

In other words, we can raise the funds needed without any general tax increase. The next administration may well want to repeal the $4 trillion Trump tax cut, or selectively raise taxes on the wealthy to finance other public needs. But a general tax increase is not needed to get to zero carbon.

Raising $300 Billion in Private Funds

Moving the $300 billion into clean-energy investments can be accomplished through a combination of sticks and carrots—i.e., strong regulations that require CO2 emissions cuts and significant subsidies for investors to invest in clean-energy projects.

Joan Fitzgerald’s article in this issue describes in depth a range of effective regulatory interventions, including renewable-energy portfolio standards for electrical utilities and energy efficiency standards for both buildings and transportation vehicles. Focusing on the subsidy side, there are several tools that can be effectively deployed, all of which are already in place or have been recently operating at some levels of the state, local, or federal government.

An obvious starting point is tax incentives. It was telling that, in the 2018 federal tax legislation, the Trump administration flinched before eliminating the generous investment tax credits provided for private clean-energy investors. At present, that credit amounts to fully 30 percent of the total investment costs.

Public policy can also significantly lower the risks, and therefore the costs, to private investors of borrowing money to finance clean-energy projects. One important tool here is Property Assessed Clean Energy (PACE) financing. Under typical PACE financing arrangements, property owners borrow from a local government or bank to finance clean-energy investments. The amount borrowed is then repaid via a special assessment on property taxes, or another locally collected tax or bill. The security of the tax collection mechanism reduces the risk to private lenders or bond investors, which in turn means that financing can be obtained at lower rates. Several states, including California, Florida, and New York, which themselves comprise nearly 25 percent of the U.S. population, have PACE financing programs presently in operation. These and similar programs in other states will need to expand greatly to help bring overall private clean-energy investments to $300 billion.

Government loan guarantees are probably the most cost-effective way for the government to provide large-scale subsidies to private-sector borrowing for clean-energy investment projects. Evidence for this comes from the loan guarantee program for renewable-energy investments that was enacted in 2009 as part of the Obama economic stimulus program, the American Recovery and Reinvestment Act (ARRA). This loan guarantee program became notorious as a symbol of government ineptitude when Solyndra, a Northern California–based manufacturer of solar panels, declared bankruptcy in 2011. The federal government was therefore obligated to pay Solyndra’s creditors the full $535 million of Solyndra’s outstanding guaranteed loans. But the program also generated successes, as noted by Mariana Mazzucato in a companion article in this issue. The fair way to evaluate the relative success of the loan guarantee program is to consider the Solyndra experience alongside the complete portfolio of other renewable-energy projects that the ARRA program subsidized.

Overall, under this ARRA-based program, the federal government provided guarantees for a total of about $14 billion for 24 clean-energy projects. Of these, there was one other loan default case in addition to Solyndra. But once one accounts for the government having recovered about 50 percent of its costs through selling the assets of the two bankrupted firms, the net federal costs of the program were about $300 million. This implies that the government spent $300 million to support $14 billion in new private clean-energy investments, amounting to a leverage ratio of $50 in clean-energy investments for every $1 in government subsidies.

If this leverage ratio could be applied to the overall clean-energy investment project that I am outlining, it would mean that only $6 billion in government outlays would be sufficient to induce the full $300 billion in new private-sector clean-energy investments. Such an elevated leverage ratio will not likely be achievable for a broader loan guarantee program. One reason is that we do not know what percentage of the $14 billion total in new investments under the ARRA program would have happened anyway, without the government guaranteeing the private investors’ loans. It is also true that achieving a high leverage ratio will be more difficult when operating the program at a much larger scale, i.e., in trying to raise $300 billion as opposed to $14 billion.

Still, while recognizing these considerations, it is reasonable to allow for a leverage ratio in the range of 10 to 1, i.e., one-fifth of the ratio that emerged out of the ARRA program. That would still mean that the federal government would need to spend a total of only $30 billion in loan guarantees to fully underwrite $300 billion in private clean-energy investments. This is without taking account of the other incentives to investors accruing through the investment tax credits, PACE financing, or other risk-reducing policy interventions. In fact, these various policies will be most effective when operating in tandem. Through their combined impacts, it should not be excessively difficult to bring total private clean-energy investments to the $300 billion target.

Climate Insurance and the Costs of Doing Nothing

What will happen if we do not succeed in stabilizing the climate? MIT climate scientist Kerry Emanuel offered the following perspectives in his 2012 book What We Know About Climate Change:

- “There will be more frequent and more intense heat waves … previously fertile areas in the subtropics may become barren, and blights may seriously affect both natural vegetation and crops.”

- “Comparatively small shifts in precipitation and temperature can exert considerable pressure on government and social systems whose failures to respond could lead to famine, disease, mass emigrations, and political instability.”

- “Were the entire Greenland ice cap to melt, sea level would increase by around 22 feet, flooding many coastal regions including much of southern Florida and lower Manhattan. Eleven of the fifteen largest cities in the world are located on coastal estuaries, and all would be affected.”

More recently, the November 2018 Fourth National Climate Assessment of the U.S. federal government, led by the National Oceanic and Atmospheric Administration (NOAA), was equally emphatic in describing the likely consequences of failing to control climate change. This report, focusing only on impacts within the United States, begins with the following overview:

More frequent and intense extreme weather and climate-related events, as well as changes in average climate conditions, are expected to continue to damage infrastructure, ecosystems, and social systems that provide essential benefits to communities. Future climate change is expected to further disrupt many areas of life, exacerbating existing challenges to prosperity posed by aging and deteriorating infrastructure, stressed ecosystems, and economic inequality.

At the same time, as all serious studies on the impact of climate change fully recognize, every projection as to the impacts of climate change must be understood in terms of probabilities and degrees of confidence, not certainties. In fact, we need to take decisive action now on climate change, not based on 100 percent certainty as to its consequences, but rather through estimating reasonable probabilities. Indeed, we should think of a U.S. clean-energy project as the equivalent of an insurance policy to protect ourselves and the planet against the serious prospect—though not the certainty—that the types of consequences described by Emanuel and NOAA could result.

We purchase insurance to protect ourselves against many other contingencies, such as house fires, automobile accidents, or serious illnesses. We do this even though we have no idea whether our house may ever burn down or our car will get totaled in an accident. From this perspective, the only major issue in dispute is how much we should be willing to pay to purchase an adequate amount of climate insurance. This is the equivalent of deciding not whether to purchase automobile insurance but, rather, how much to spend and how much coverage we need.

In addressing this question, it is critical to recall the point I emphasized at the outset, that the net costs of the clean-energy investment project will be zero over time. That is, the program will pay for itself over time because (1) the energy efficiency investments will enable all energy consumers to spend less money to obtain the energy services they want; and (2) the costs of clean renewable energy are already at cost parity with fossil fuels, and those costs will be falling further through additional innovations. We will need to invest something like $18 trillion over a 30-year period to build a 100 percent clean-energy infrastructure in the U.S. But these investments will come back to us through lowering the costs of consuming the energy we need for all our various purposes.

After accounting for the full range of factors at play with a U.S. clean-energy project, we can conclude that, on balance, the costs of purchasing global climate change insurance will be modest. It is an insurance policy we can unquestionably afford to pay for, even if, in the unlikely event, the prevailing scientific consensus on climate change does turn out to be wrong. The alternative to not purchasing this insurance policy is, effectively, to play Russian roulette with the fate of the Earth.