Just When Should We Start Worrying About Deficits?

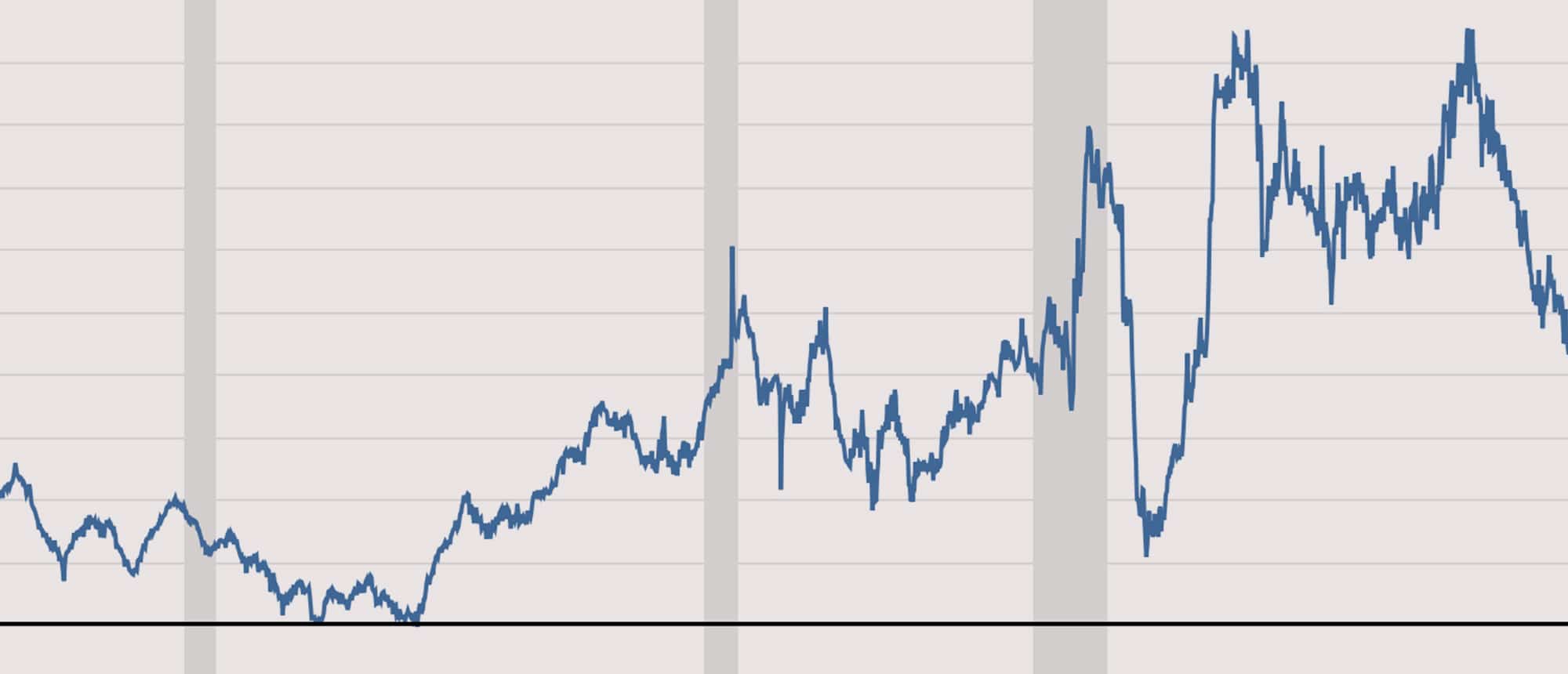

The U.S. deficit is rising again, a lot. The Congressional Budget Office just said it expects the deficit to top $1 trillion in 2019, a record. Some economists say that at some point, debt becomes a drag on growth. Is the U.S. approaching that threshold? Should we be worried? Bloomberg Opinion columnists Stephanie Kelton and Noah Smith met recently online to debate.

Stephanie Kelton: I don’t find the projections particularly interesting, nor do I find them disturbing — at least not in the “OMG trillion-dollar deficits are coming! Run for the caves!” sort of way. What I find interesting is not the budget forecast itself but the fact that Republicans added roughly $2 trillion in stimulus at a time when nearly everyone said it shouldn’t be done, citing proximity to full employment. “You don’t do stimulus at full employment,” was basically the argument. Well, here we are well into the experiment and … what’s the problem? Inflation remains in check, unemployment has ticked down a bit further, small business confidence is at a 45-year high and growth has accelerated. So that’s interesting.

Noah Smith: Here’s the problem. If you have a basic aggregate demand, Phillips-curve sort of view of the economy, then if stimulus is giving the economy a boost, it should also be raising inflation. Core inflation hasn’t accelerated and is right around the 2 percent target, even as unemployment has dropped, which raises the question of whether the tax cuts are really delivering much stimulus to the economy. We have reason to think that tax-cut multipliers are lower than spending multipliers, and that multipliers during booms are lower than multipliers during recessions, which tends to back up the notion that the tax cut probably isn’t doing much in the way of stimulus — the economy is recovering for other reasons. So really we’re just racking up debt in order to make the tax system more regressive. Is that wise?

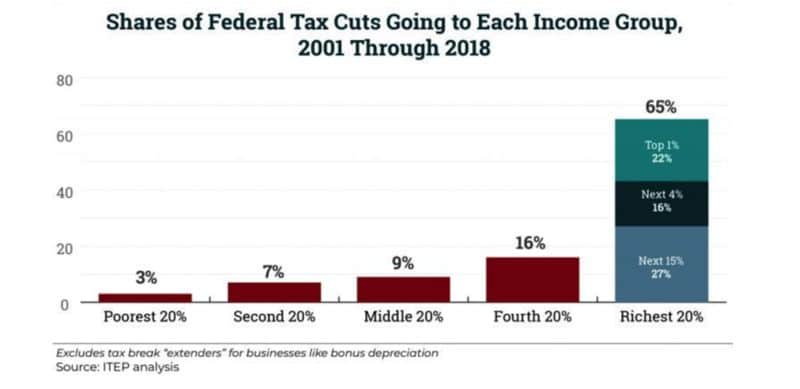

SK: I agree that there were better ways to use the $2 trillion or so in fiscal space that we clearly had available at the start of the year. And, yes, the Republicans mostly used deficits to deliver a windfall to big corporations and the richest people in America, dishing out crumbs across the rest of the income distribution.

Here’s who benefited from the last round of tax cuts:

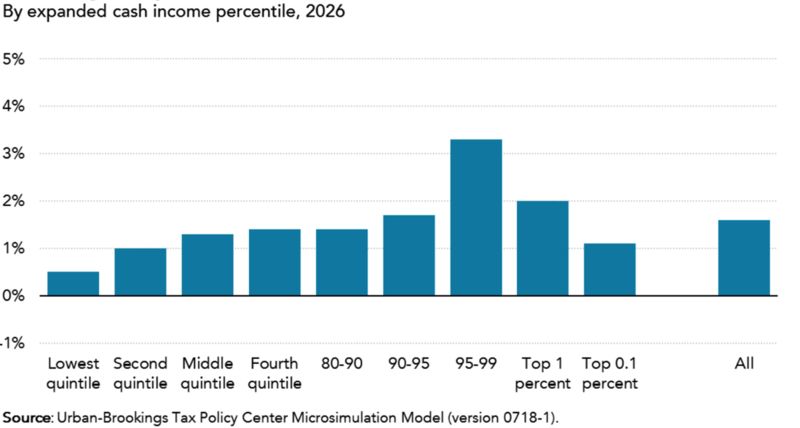

No one knows exactly how much of the pickup in economic activity is due to the tax cuts, but it ain’t zero. So they helped. And, as you note, they helped without raising inflation, which tells me they didn’t overstimulate, which further tells me there may be room to do even more. Tax Cuts 2.0, anyone?

Here’s who would benefit from the next round:

But here’s the thing Republicans seem to understand really well: The federal government’s deficit shows up as a surplus in some other part of the economy. And so while critics use terms like, “blowing up the deficit” or “drowning in red ink” to describe what’s happening to the government’s finances, Republicans seem more interested in the fact that their deficits will improve the private sector’s finances, especially the biggest corporations and wealthiest people in America. In other words, the GOP seems to understand that the government’s red ink is our black ink! It’s a point Goldman Sachs’ chief economist, Jan Hatzius, has made emphatically. And, of course, modern monetary theory folks routinely make the same point.

Instead of saying, “The 2018 budget deficit is expected to be $804 billion, rising to $1 trillion in 2019,” we could say, “The surplus in the non-government sector is expected to be $804 billion, rising to $1 trillion in 2019.” Is that disturbing?

NS: Why should we care about the private sector’s net surplus? According to the theory of balance sheet recessions, and to the theory of debt deflation, and also to the theory of the leverage cycle, it’s the private sector’s gross debt that poses a danger to the economy. In other words, what matters is how much companies and private individuals owe to each other, not how much the government owes them. So the point about the private sector’s net surplus is a bit lost on me. Who cares?

SK: Debt is only part of it. The other issue is the servicing of debts; if you moved everyone from 15-year mortgages to 30-year mortgages, you’d likely end up with higher debt-to-income and higher assets, since more people can handle the payments, and those that could already handle the payments can now afford the payment on more house. But the ability to service the debt is likely greater, all else equal. Even standard neoclassical macroeconomics on sustainable finance emphasizes the debt-service ratio over the debt ratio, even as the debt ratio obviously plays a role.

Setting aside the debate about the relative importance of debt-to-income or assets, or debt service, a government deficit adds to private-sector incomes (relative to debt or debt service) whereas a government surplus has the opposite effect. The most intuitive way to show this is through the sector financial balances. This becomes clear if you listen to Hatzius explain why he thinks sector-balance analysis can send a signal when the private sector’s financial positions are becoming overly fragile. And because it’s nothing more than accounting, it also tells us that the crowding-out story is 100 percent wrong — a government deficit raises private sector incomes; it doesn’t crowd out private finance.

NS: Putting aside the argument over financial crowding out, I still don’t see the relevance of all this. Let’s think in terms of real resources — not dollars, surpluses and deficits, but cars, pizzas, hours of labor. It seems clear to me that unless we have unused resources in the economy — idle workers and idle factories — that a government deficit can’t increase real output. At the end of the day, real output is what we care about — you can’t eat dollars, but you can eat pizzas. And if the U.S. economy is indeed nearing full employment, it means that there aren’t many unused resources lying around — and hence, the real benefit from deficits seems low. This is just standard Keynesian economics.

As for the financing side of things, the reason government debt matters is because of how government finances its borrowing. If it uses tax financing — including future tax financing — that can hamper the economy. If it uses monetary financing — getting the central bank to print money to finance the Treasury’s deficits — that could at some point explode into uncontrollable inflation. What do you have to say to those worries?

SK: This actually isn’t right. If the government were to finance itself by so-called money printing, that would mean either (a) the government runs an overdraft at the Federal Reserve, or (b) the Fed buys the government’s bonds, which leaves reserve balances in the Fed accounts of private banks instead. But, for the Fed to achieve a positive interest-rate target, it would have to pay interest on reserve balances at its target rate. In other words, printing money simply means that overnight central bank liabilities earning the central bank’s target rate replace, say, three-month government liabilities earning roughly the central bank’s target rate. And if the Fed doesn’t pay interest on these reserve balances, then that simply means it wants its target rate at zero. Overall, there’s little difference in terms of macroeconomic impact whether the government sells its securities or prints money because the latter isn’t actually a thing in the real world. And while this is something MMT has been saying for 20 years, it’s basically what Narayana Kocherlakota, former president of the Federal Reserve Bank of Minneapolis, said a few years ago, too.

So the point is that deficits, per se, are not disturbing. Is there a limit to how big the deficit can safely climb? Absolutely! Deficits matter. They can be too big — risking accelerating inflation. But they can also be too small, robbing the economy of a critical source of income, sales and profits. At some point, something will happen to undermine the strength of demand in the U.S. economy, and the expansion will end. Given the current inflation outlook, I see no reason to believe that trillion-dollar deficits pose a risk to the expansion. If anything, it will be the Fed’s reaction to those projected deficits that brings the expansion to an end.

NS: It seems like you’re agreeing with me that accelerating inflation is a risk of deficits. The question is whether that would come slowly or quickly. If deficit-induced inflation comes slowly, we don’t have much to worry about, because we can see it coming and adjust policy accordingly. But if it comes quickly — if the economy switches suddenly between a low-inflation equilibrium and a high-inflation equilibrium — then the dangers of deficits wouldn’t become apparent until it was too late. Of course, we can never know where that breaking point is, so it’s hard to decide just how much precaution to take. But with the labor market looking very strong, it seems like the potential benefit of large deficits at this point in time is small. So it seems like an unknown risk in exchange for only a small potential gain — not the most enticing of gambles.