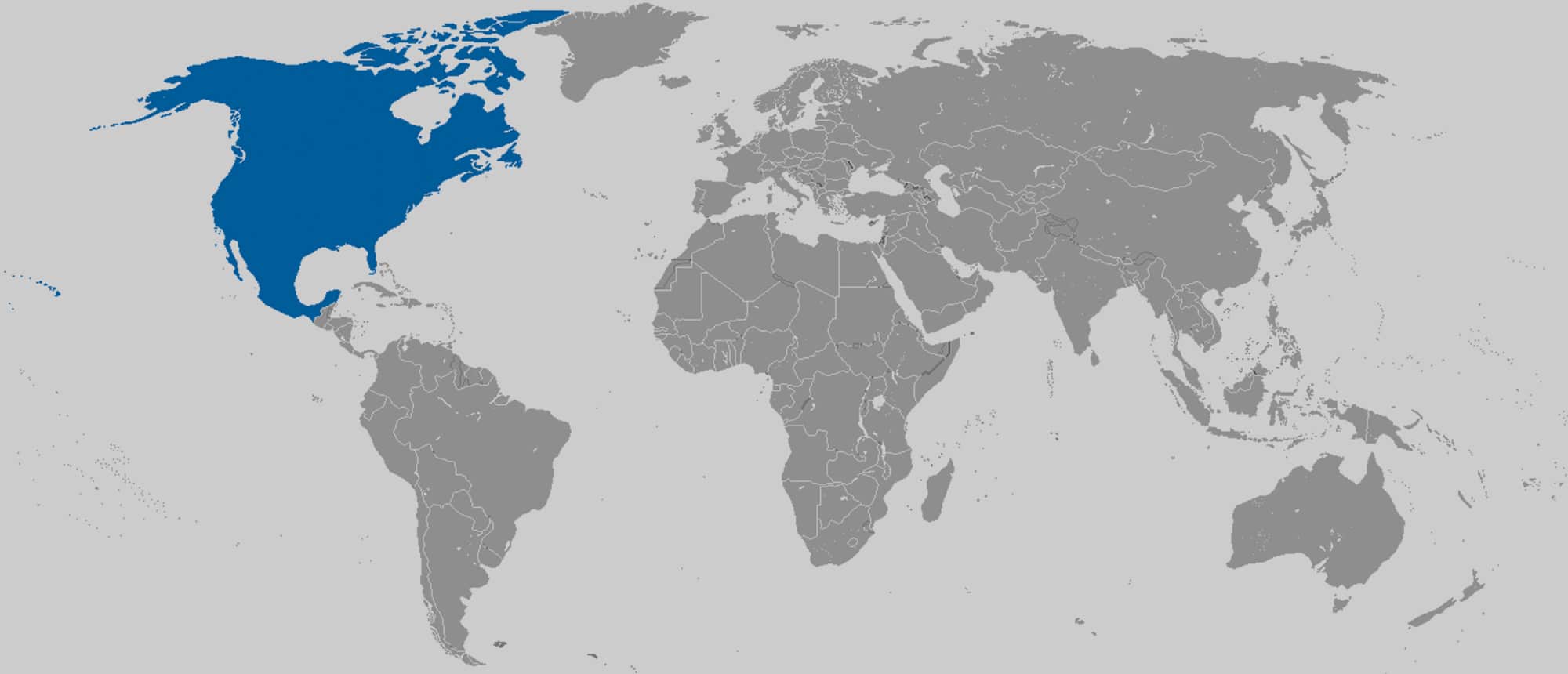

NAFTA’s Legacy: Expanding Corporate Power To Attack Public Interests Laws And Outsource Jobs

At the heart of the North American Free Trade Agreement (NAFTA) is a stunning corporate power grab: NAFTA grants rights to thousands of multinational corporations to bypass domestic courts and directly “sue” the U.S., Canadian and Mexican governments before a panel of three corporate lawyers.

These lawyers can award the corporations unlimited sums to be paid by taxpayers, including for the loss of expected future profits. These corporations need only convince the lawyers that a domestic law, safety regulation or court ruling – that we rely on for a clean environment, essential services and healthy communities – violates the new rights and privileges NAFTA grants to them. The corporate lawyers’ decisions are not subject to outside appeal.

How could multinational corporations attack domestic health, environmental and financial protections on which we all rely and that local companies have to follow?

NAFTA and other corporate-rigged deals include terms formally known as Investor-State Dispute Settlement (ISDS). ISDS gives multinational corporations stunning powers, including the ability to challenge new policies – from Wall Street regulations to climate change protections – if corporations claim these policies violate their NAFTA rights and frustrate the corporations’ “expectations” of how they should be treated.

If an ISDS tribunal of three corporate lawyers rules against a challenged policy, there is no limit to the amount of taxpayer money a government can be ordered to pay a corporation. The amount is based on the “expected future profits” the tribunal surmises that the firm would have earned in the absence of the policy it is attacking. The number of ISDS attacks launched each year has exploded in recent years and the variety of policies being attacked is expanding.

Conflicts of Interest

NAFTA allows the lawyers on these tribunals to rotate between serving as “judges” and bringing cases for corporations against governments – a conflict of interest that would be forbidden as highly unethical under most legal systems. These “tribunalists,” as the three private sector attorneys are formally called, are not bound by precedent or the opinions of governments about what an agreement means. And there is no outside appeal to their rulings. If governments do not pay, the corporations can seize government property or assets directly to make up the ordered amount.

If that were not sufficiently outrageous, these special protections for multinational corporations also incentivize job offshoring. These corporate rights and powers eliminate many of the usual costs and risks that make firms think twice about moving to low-wage countries, literally incentivizing corporations to launch a new wave of job offshoring.

While this shadow legal system for multinational corporations has been around since the 1950s, just 50 known cases were launched in the regime’s first three decades combined. In contrast, corporations have launched approximately 50 claims in each of the last six years. ISDS is now so controversial that some governments have begun terminating their treaties that include ISDS.

NAFTA Cases Target Health and Environmental Policies

More than $392 million in compensation has already been paid out to corporations in a series of investor-state cases under NAFTA. This includes attacks on oil, gas, water and timber policies, toxics bans, health and safety measures, and more. In fact, of the 11 claims (for more than $36 billion) currently pending under NAFTA, nearly all relate to environmental, energy, financial, public health, land use and transportation policies – not traditional trade issues.

Here are just some examples of the overreach of the ISDS system under NAFTA.

The Investor Wins Taxpayer Compensation via Tribunal Order

Bilcon v. Canada: A NAFTA ISDS tribunal ruled in favor of a company that planned to blast a basalt quarry and marine terminal in an environmentally-sensitive area in Nova Scotia, deciding that the impact assessment that had been ordered by Canada’s Department of Fisheries and Oceans was a violation of the company’s NAFTA rights. A dissenting tribunalist called the decision “a remarkable step backwards in environmental protection.” But the Canadian government was ordered to pay more than $100 million to the firm.

Mobil / Murphy Oil v. Canada: A NAFTA ISDS tribunal ruled in favor of U.S. oil corporations Mobil (of ExxonMobil) and Murphy Oil, deeming a Canadian province’s requirement that any firm—domestic or foreign— obtaining a drilling license must contribute a small share of oil revenue to fund research and development in Newfoundland and Labrador – one of Canada’s poorest provinces. The tribunal ruled this was a NAFTA-barred performance requirement and ordered the Canadian government to pay the firms $19 million.

Metalclad v. Mexico: A Mexican municipality’s refusal to grant U.S. firm Metalclad a construction permit, which it had also denied to the contaminated facility’s previous Mexican owner (until and unless the site was cleaned up), resulted in $15.6 million in compensation being paid by Mexico to the firm after one of NAFTA’s first ISDS rulings.

S.D. Myers v. Canada: A NAFTA ISDS tribunal ordered Canadian taxpayers to pay $5.6 million for a temporary Canadian ban on the export of a hazardous waste called polychlorinated biphenyls (PCB). Though the ban complied with a multilateral environmental treaty encouraging domestic treatment of toxic waste, the tribunal deemed it to be discriminatory and a violation of the corporation’s NAFTA right to a “minimum standard of treatment.”

The Investor Extracts Payment Through a Settlement

Ethyl v. Canada: The U.S. Ethyl Corporation used NAFTA’s investor-state system in the late 1990s to reverse a Canadian environmental ban of the carcinogenic gasoline additive MMT, also banned by numerous U.S. states, while also obtaining $13 million in compensation from the Canadian government to pay for revenue lost during the ban. Canada also was required to post advertisements in newspapers claiming the chemical was safe.

AbitibiBowater v. Canada: AbitibiBowater, a paper corporation, extracted a $123 million ISDS settlement after challenging the decision of Newfoundland and Labrador, a Canadian province, to take back various timber and water rights held by AbitibiBowater after the corporation closed a paper mill. The provincial government argued that under the terms of an agreement the firm had made with the province, which was working to save the mill that employed 800 people in a rural area, AbitibiBowater’s control of the forest lands and water rights were contingent on the company’s continued operation of the paper mill.

Pending Cases With Health and Environmental Implications

TransCanada v. United States: In June 2016, the TransCanada Corporation launched a NAFTA ISDS claim demanding $15 billion in compensation because the Canadian corporation’s bid to build a pipeline was rejected by the U.S. government. The company said it had invested $3 billion, but demanded the larger sum to pay for the future expected profits it would lose if the pipeline was not allowed to operate. The U.S. government decision not to approve the pipeline, because it was not in the national interest and would exacerbate climate change, came after years of government studies. Tens of thousands of citizens in the states that would be affected and environmental activists nationwide had worked for years to demonstrate that the pipeline would pose serious health and environmental risks. Even after President Trump announced he would reverse the Obama administration decision and allow the pipeline to proceed, TransCanada is proceeding with its ISDS case. Under NAFTA rules, it could be compensated for lost revenues and costs that resulted from a delay in the pipeline’s completion.

Lone Pine v. Canada In September 2013, Lone Pine Resources, a U.S.-based oil and gas exploration and production company, launched a $109 million NAFTA ISDS claim against Canada under NAFTA to challenge Quebec’s suspension of oil and gas exploration permits for deposits under the St. Lawrence River. The decision was part of a wider moratorium on the controversial practice of hydraulic fracturing, or fracking. The provincial government had declared a moratorium in 2011 so as to conduct an environmental impact assessment of the extraction method widely known for leaching chemicals and gases into groundwater and the air.

Eli Lilly v. Canada In September 2013, U.S. pharmaceutical giant Eli Lilly and Company, launched a $483 million NAFTA ISDS challenge after Canadian courts invalidated the firm’s patents for Strattera and Zyprexa, drugs used to treat attention deficit hyperactivity disorder, schizophrenia and bipolar disorder. In a case that greatly expands the scope of ISDS attacks, the firm is challenging Canada’s standard for issuing patents. Canadian federal courts ruled that Eli Lilly failed to meet the standards required to obtain a patent under Canadian law. Namely, the firm had failed to demonstrate or soundly predict that the drugs would provide the benefits that the firm promised when applying for the patents’ monopoly protection rights. The court’s decision paved the way for generic drug producers to make less expensive versions of the drugs. Eli Lilly is asking a NAFTA ISDS tribunal to second-guess not only the courts’ decisions, but Canada’s entire standard for issuing patents and determining their ongoing validity.

NAFTA ISDS Attacks Force Costly Defense of U.S. Policies

The U.S. government has spent tens of millions in legal costs to defend against NAFTA investor-state cases. But, thanks in part to technical errors by lawyers representing corporations in several cases, the United States has thus far dodged the bullet and avoided paying compensation. There have been 14 ISDS cases against U.S. policies–all by Canadian firms under NAFTA. A Columbia University Law School study shows that we have only narrowly escaped liability in some of these cases. For example, in the Loewen case, a NAFTA tribunal concluded that a Mississippi state Supreme Court decision that a Canadian funeral home conglomerate must follow normal civil procedure rules and post bond to appeal a contract dispute it had lost with a U.S. firm, violated NAFTA investor protections. Luckily for U.S. taxpayers, before compensation was ordered, the Canadian firm’s lawyers reincorporated the firm as a U.S. corporation under bankruptcy protection. This eliminated Loewen’s status (and privileges) as a foreign investor.

When U.S. state laws are challenged under the investor-state system, state governments have no standing and must rely on the federal government to defend their laws. If states are invited by federal officials to participate, they must pay their own legal expenses. California has incurred millions of dollars in legal costs helping to defend two state environmental laws – a toxics ban and a mining reclamation policy – that were challenged under NAFTA.

As corporations and law firms become emboldened and more creative, it is likely only a matter of time before U.S. taxpayers are on the hook, given that as long as NAFTA is in effect, more than 8,500 corporate subsidiaries from Canada and Mexico are empowered to use ISDS to challenge our policies.