Federal Reserve Board Chairman Alan Greenspan was one of the most powerful men in the world for nearly two decades. His pronouncements could cause stocks to soar or crash.[1]

“First nominated to the Federal Reserve by President Ronald Reagan in August 1987, he was reappointed at successive four-year intervals until retiring on January 31, 2006, after the second-longest tenure in the position. Democratic leaders of Congress criticized him for politicizing his office because he supported Social Security privatization and tax cuts. Many have argued that the “easy-money” policies of the Fed during Greenspan’s tenure, including the practice known as the “Greenspan put,” were a leading cause of the dot-com bubble and subprime mortgage crisis (the latter occurring within a year of his leaving the Fed), which, said The Wall Street Journal, “tarnished his reputation.” Yale economist Robert Shiller argues that “once stocks fell, real estate became the primary outlet for the speculative frenzy that the stock market had unleashed.”[2]

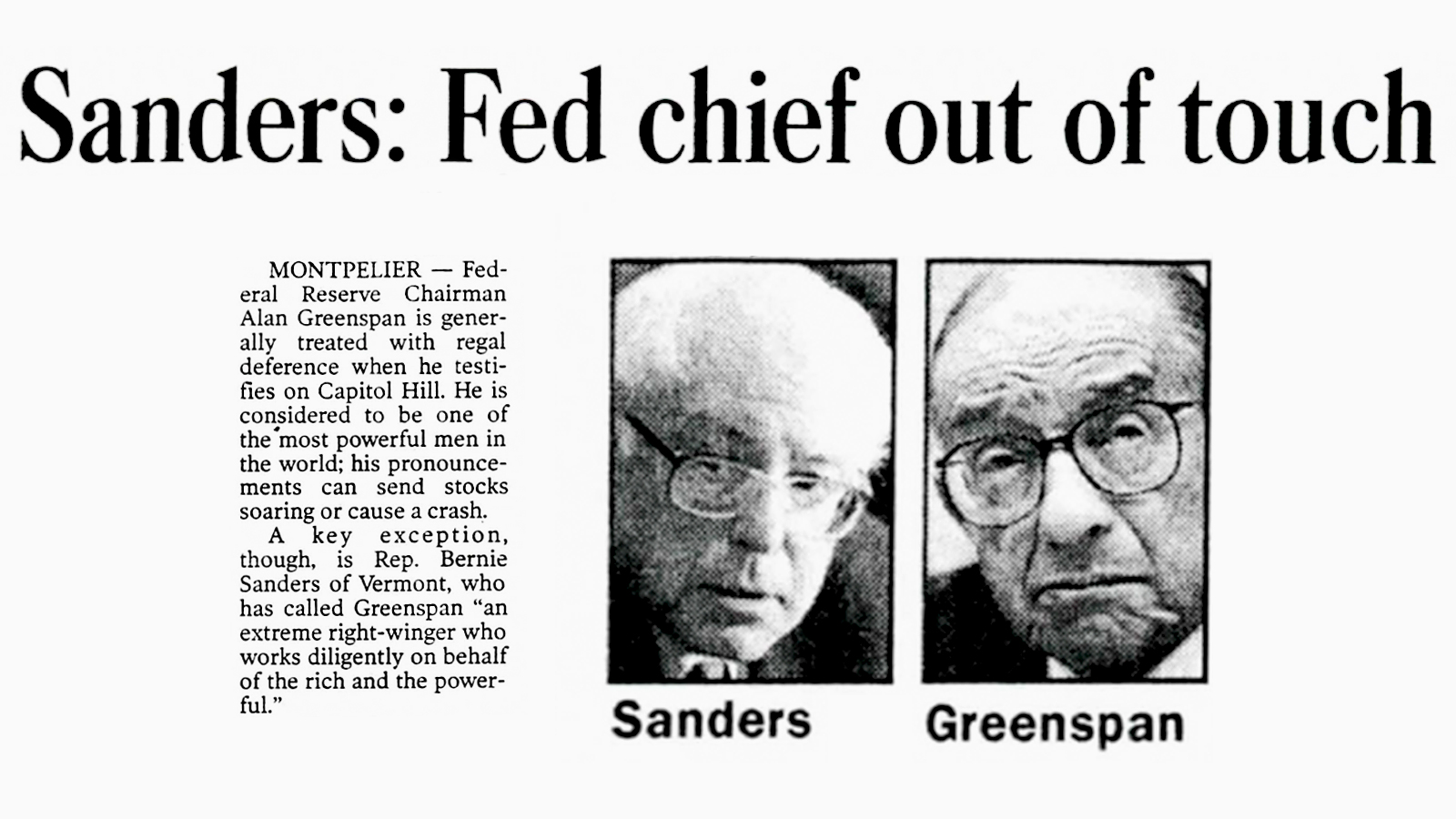

But the power Greenspan wielded meant that he was treated with “regal deference” on Capitol Hill during biannual testimonies.[1] Bernie Sanders, however, was always there to hold him accountable. In a 2003 House Financial Services Committee hearing, Sanders and Greenspan’s sparring reached new heights – and generated national headlines.[1]

An excerpt from Sanders’ statement:

“Mr. Greenspan, I have long been concerned that you are way out of touch with the needs of the middle class and working families – that you see your major function and your position as the need to represent the wealthy and the large corporations. And I must tell you that your testimony today only confirms my suspicions.

“You talk about improving economy while we have lost 3 million private sector jobs in the last two years; long-term unemployment has more than tripled; unemployment is higher than it has been since 1994; we have a $4 trillion national debt; 1.4 million Americans have lost their health insurance; millions of seniors can’t afford prescription drugs; middle-class families can’t send their kids to college because they don’t have the money to do that; bankruptcy cases have increased by a record-breaking 23 percent; business investment is at its lowest level in more than 50 years; CEOs make more than 500 timed what their workers make; the middle class is shrinking; we have the greatest gap between the rich and the poor of any industrialized nation – and this is an economy that is improving?! I’d hate to see what would happen if our economy was sinking.”[1]

Sanders had called out Greenspan in a similar debate during a 1997 House Banking Committee meeting, where Greenspan opposed raising the minimum wage and sought to cut social security benefits and taxes for the wealthy.

In the 1997 meeting, Greenspan characterized the U.S. economy as “exceptional” during his mid-year assessment. Sanders said that the economy may be “exceptional” for upper-income families but that the middle-class and working families of Vermont and America were continuing to struggle to maintain their current standard of living.[3]

In a statement before the Subcommittee, Sanders said, “In recent years, Mr. Greenspan, you have been telling us how strong the economy is and what a wonderful economic period we live in. Today, you used the word “exceptional” to describe the economy. I must tell you, however, that is not the assessment of the working families in my state of Vermont, nor, I believe, throughout this country. For the wealthy, it is true that things have never been better, but for middle-income and working families who are working longer hours for lower wages, that is most certainly not the case.”[3]

“While unemployment is relatively low, most new jobs created are low-wage, part-time, or temporary. Americans at the bottom of the wage scale have become the lowest paid workers in the industrialized world. Eighteen percent of those with full-time jobs are paid so little that their wages don’t enable them to live above the poverty level. And to compensate for declining wages, the average American worker is working about 160 hours a·year more than he or she did twenty years ago. The number of people working at more than one job has almost doubled over the last 15 years. That does not sound like an ‘exceptional’ economy to me.”[3]

Sanders continued, “Last year, the CEOs of major corporations saw a 54% increase in compensation, while millions of workers continued to see a decline in their real wages. The CEOs of major corporations now earn over 200 times what their workers make, and the United States has the most unequal distribution of wealth and income in the industrialized world. The wealthiest one percent of our population now owns close to 42% of the nation’s wealth, more than the bottom 90%. While the rich get much richer, the middle class continues to shrink. I find it incredible that the head of the Federal Reserve Board could describe the State of the Economy as exceptional.[3]

Back to Timeline

Back to Timeline