Inflation Has Come Down In Spite Of The Fed, Not Because Of It

US Federal Reserve chair Jay Powell is earning plaudits these days because a scary spike in US inflation appears to be receding without major job losses or economic contraction.

But American economist Stephanie Kelton argues that the Fed’s role in creating a “soft landing” is wildly overstated. A leading proponent of modern monetary theory, she contends that higher interest rates do not always slow economic growth. When a mismatch between supply and demand causes inflation, governments are mistaken if they try to tame it by cutting government deficits and crimping demand. “A better way to resolve the imbalance is through boosting supply,” she argues.

To that end, she believes the White House ought to focus on building up the US economy’s ability to create more goods and services, by redoubling its efforts to stimulate investment in fighting climate change, building more housing and making childcare affordable.

Kelton, an economics professor at Stony Brook University in New York and a former adviser to Bernie Sanders’ 2016 presidential campaign, has decidedly nonconformist views. She considers rising bond yields to be a subsidy for “people who already have money”. So she thinks the US should stop selling Treasuries to fund the federal deficit and governments everywhere ought to invest in public jobs programmes so that workers who lose their jobs never become fully unemployed: “It would truncate downturns, provide income support where it’s needed and enhance price stability,” she says.

Her views challenge those of traditional economists and budget hawks, who are concerned that US government debt just topped $34tn. They contend that the fact that Covid-era fiscal stimulus was followed by rapid inflation is evidence that MMT has too benign a view of government deficits.

In this interview, Kelton offers her counterargument and discusses some of the ideas behind her upcoming book.

Brooke Masters: So Stephanie, we are in a period where inflation absolutely shot up and is now maybe coming down. Why do you think this happened?

Stephanie Kelton: I think a substantial factor is the pandemic. Everyone remembers the supply chains breaking and we all saw images of ships backed up at ports, and we know that shipping costs increased. We also couldn’t spend money the way we were accustomed to. In the US, 80 per cent or so of economic activity is wrapped up around the service sector, and all of a sudden we were told you can’t go to restaurants and bars and nail salons. So what did we do? We ploughed a lot of money into goods that had to be manufactured somewhere and transported to us.

So we got early inflation in durable goods, and then a series of supply shocks. The pandemic came in waves, and different parts of the world were shutting factories down at different times. Then of course Russia and Ukraine, and another round of energy and food price shocks and we just found ourselves dealing with supply shock after supply shock.

BM: But you also hear people say, “Spending by governments caused this.”

SK: We can’t ignore that part of the story. Governments around the world responded, to varying degrees, with fiscal policy, some with very bold programmes. In the case of the US, it was really three big fiscal packages [that included] stimulus cheques, support in the form of child tax credit expansion, payroll protection programmes and expanded employment insurance benefits. That definitely put a lot of money into a lot of people’s hands.

It was the collision of the pandemic, the added income support and the brittle supply chains that combined to give us that early inflationary pressure. There is also evidence that, later, once we all got kind of accustomed to prices going up, companies started taking advantage of that inflationary environment to push prices up even higher to fatten up their profit margins. People threw around terms like “greedflation” and many people tried to dismiss it but I think we can’t ignore that completely. It was a factor at play.

BM: Why does inflation seem to be plateauing and coming down? Is it just that the demand slowed down and supply chains untangled, or was it the government?

SK: Mostly, it was the former. The forces that drove inflation up in the first place reversed themselves. Basically we’re getting back to normal. I think it was always destined to happen. I was a vocal member of “team transitory”, and I never used the word transitory to mean shortlived. I meant that inflationary pressures would abate when enough time had passed to allow the snarls in the supply chain and the things that had disrupted the economy to work themselves out. I didn’t expect prices to return to what had been “normal”, but I thought inflationary pressures would largely abate on their own.

BM: Given that you think inflation is transitory, should the US Federal Reserve stop raising rates? Should it cut rates?

SK: If you annualise the last six months, US inflation is running at 1.9 per cent. The Fed’s target is 2 per cent for core PCE [personal consumption expenditure]. If we look at the eurozone, year over year, headline inflation has come crashing down faster than anticipated. It’s running at 2.9 per cent and the six month annualised core rate is 2.15 per cent.

Everybody talks about a soft landing and the Fed pulling off the near impossible. But from where I sit — and this is definitely not the conventional view — I don’t want to give central banks a whole lot of credit. My view is that economists and other experts have overestimated the role of monetary policy.

I think inflation has come down in spite of what the Fed has done, not because of what the Fed has done. Think back to what happened after the 2008 financial crisis, when central banks the world over were trying to get inflation up to their 2 per cent targets. We watched the European Central Bank and the Bank of England and everybody just struggling, year after year after year, running quantitative easing, zero interest rates and all the rest, trying to push inflation higher.

It didn’t work, but somehow we’re all supposed to believe that monetary policy is really effective if you turn the dials in the other direction. Why should we believe that?

BM: Believing the Fed doesn’t matter very much is definitely an unconventional view.

SK: When central banks raise interest rates, of course it matters. The cost of financing a home has increased a lot. It costs a lot more money if you want to buy a car and you’ve got to finance it. Your credit card bills are higher. That’s the brake pedal. It’s meant to slow spending. That’s the goal of the Federal Reserve, to slow everything down and get some disinflationary pressures under way.

Ironically, you’re trying to fight the cost of living crisis by raising the cost of living for millions of people.

But economists like me who look at this through the lens of modern monetary theory understand that there is also an accelerator effect from the Fed raising interest rates and this is too often under-appreciated.

When the Fed raises interest rates, it forces the Treasury to pay out more in interest income to bondholders as bonds mature and new securities are issued. All of a sudden the government is paying out hundreds of billions of dollars in additional income to holders of US Treasuries. That income can be saved, used to pay down debt, or spent back into the economy.

It’s like a basic income payment that goes to relatively wealthy people. You have to have enough comfort in your income level to be a saver, to have dollars that you can park in Treasuries in order to capture that subsidy. So it is a regressive form of fiscal stimulus.

Effectively, the central bank has put a part of fiscal policy on autopilot. The Treasury is paying out all this additional interest income because of the actions of the Fed.

BM: So from your point of view, the negative impact of a rate increase on car prices and house prices affects everybody, but relatively the benefits of it go to the rich. Does that mean the Fed should stop raising rates?

SK: I don’t think the rate hikes are working to reduce inflation. They create winners and losers and it looks to me, so far at the macro level, like the boon to the winners has more than offset the hit to the losers. The US economy grew at 4.9 per cent in real terms in Q3. It’s allowed the economy to churn out these incredible growth numbers. But I don’t view this as the best use of fiscal space. You hear people complain that the federal government is spending more on interest than on the military. Interest payments are getting be around $1tn a year in subsidies for people who already have money.

Brooke: You also look at government deficits differently from many conventional economists. They tend to associate big government deficits with increased inflation. Do you buy that?

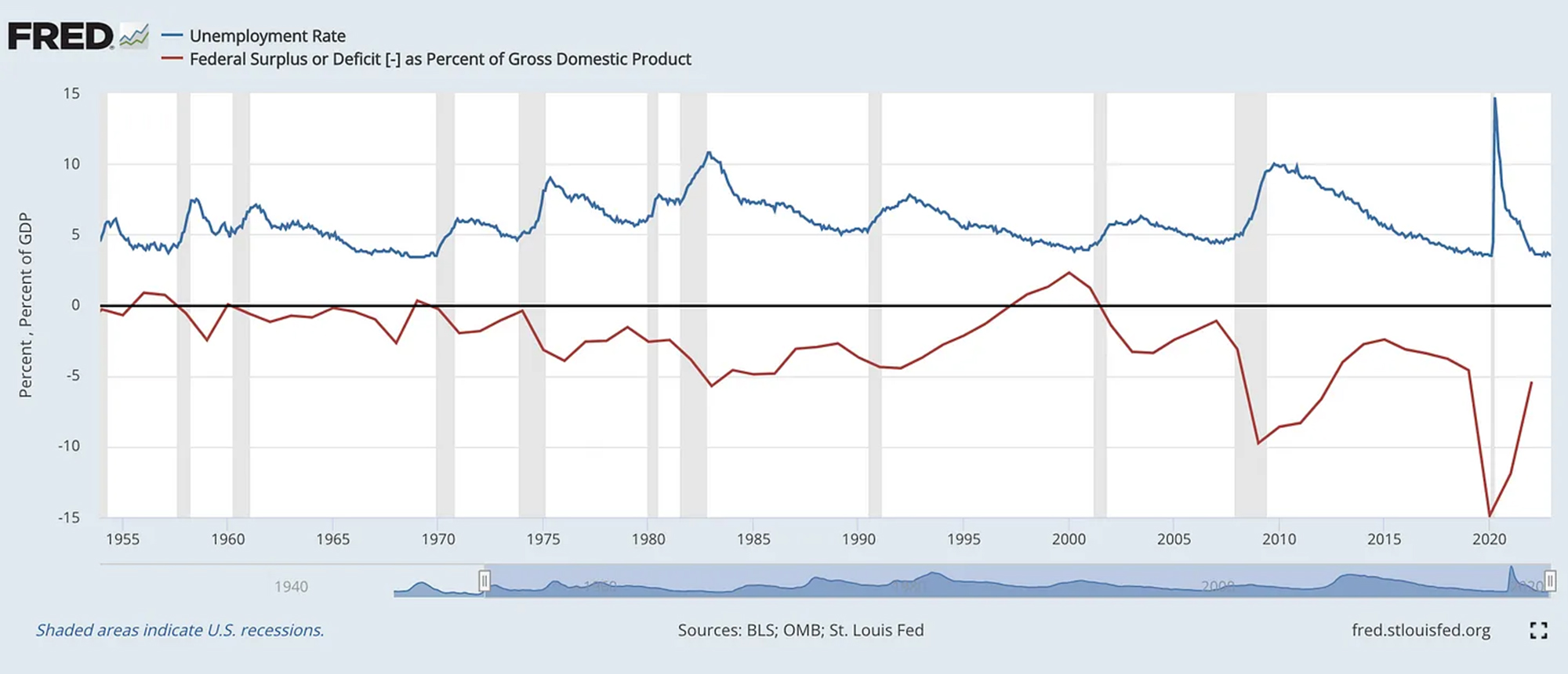

SK: No. First, this idea that deficits are inherently inflationary is pretty easily debunked, just by looking at the data. Japan has had large fiscal deficits, persistent deficits for the last three decades and, until Covid, no inflation to show for it. Clearly, you can have very large chronic deficits without an inflation problem.

Then look at the Clinton years. The federal government’s budget was in surplus for four years from 1998 to 2001, but inflation accelerated and ended up at 3 per cent. Then you had the period after the financial crisis, again large fiscal deficits in the US, QE, zero interest rates, and we couldn’t get core inflation up to 2 per cent. There’s no direct relationship between the size of the deficit and inflation.

BM: Should we cut interest rates and have the government switch from paying interest on Treasuries to spending more?

SK: I don’t see the benefit of keeping interest rates high. I think Congress should use the fiscal space that’s available to them to deliver meaningful improvements in people’s lives. We’re short millions of units of housing. We absolutely should be dealing with that, which would help with the inflation problem over time, because chronic shortages are a big part of the reason why the price of shelter is going up so rapidly.

BM: You have called bonds a big giveaway. Walk me through that, because most people don’t see it that way.

SK: What is the real purpose of bonds? We have a floating exchange rate and a fiat currency. The federal government doesn’t promise to pay defence contractors, civil servants or any of its vendors in US Treasuries; they promise to pay US dollars. So why does it issue bonds?

Think about what would happen if it didn’t and just spent more than it taxed. When the government spends, someone receives a payment that is deposited into a bank account and some bank ends up with a credit to its reserve account at the Fed. You get a newly created demand deposit and new base money in the form of reserves. When we pay taxes, the reverse happens. Accounts are debited and money is deleted out of the system. When the government spends more than it subtracts away by taxing, it leaves the banking system as a whole flush with excess reserves.

In the old days, this would push the overnight interest rate down, as banks tried to rid themselves of excess reserves in the Fed funds market. The bid for those funds would quickly fall towards zero. To hit a positive interest rate target, bonds were sold to mop up the excess reserves and move the interest rate higher. Everyone thinks the government sells bonds to finance fiscal deficits, but the real purpose was to avoid moving the interest rate away from the central bank’s target.

But we aren’t in that world anymore. Today, the Fed hits its interest rate target by paying interest on reserves. It just announces what the interest rate is and pays it. So, what is the further purpose of selling Treasuries? We could just let the reserves pile up in the system, where they would earn whatever the Fed chooses to pay.

BM: If they just stopped selling bonds and said, we’re just going to run deficits, conventional monetary folks would say that the US would be hit by horrifying inflation. Why don’t you believe that will happen?

SK: Because the inflation is embedded in the spending itself, not in whether the bonds are sold or not sold. Countries that experience hyperinflation sell bonds.

I used to play this little game when I was the chief economist for the Democrats on the Senate budget committee. I would ask either members of the Senate or their staff, if you had a magic wand and you could wave the magic wand and make the US national debt just disappear, would you wave the wand? Everyone immediately says, “Yes.” No hesitation. Then you say, what if I gave you a different wand that would eradicate the world of US Treasuries? Bills, bonds, notes, they’re all just gone. Would you wave that wand? People would say, “Why on earth would I do that?”

It was so telling, because I was asking the same question two different ways. This thing we call the national debt is nothing more than the whole of the US Treasury market. They’re one and the same.

Politicians don’t like debts and deficits because their constituents hear it and think that they’re somehow mismanaging the nation’s finances. But Treasuries are seen as benign and desirable. I’m trying to help people understand that selling bonds is a policy choice, not an economic imperative. The Treasury market is nothing more than our after-tax savings.

BM: So would you stop selling new bonds?

SK: At this point, yes. There’s too much confusion about why governments issue bonds, and it leads to bad public policy. Instead of having the Treasury issue securities to match the deficit, you could let the Fed issue securities and chose the interest rate on different securities. It would just make everything more transparent.

BM: Does it matter whether the US is in surplus or in deficit?

SK: It matters because government deficits are the sole source of net financial assets, in dollars, for the non-government sector. Any economy in the world can be broken down into three parts: the domestic private sector, the domestic public sector and the rest of the world. There will be sectors in deficit and sectors in surplus. It’s impossible for everyone to be in surplus at the same time. In the US, we run current account deficits with the rest of the world, which means our trading partners are in surplus.

Everything must net to zero, leaving only two options: either the US private sector spends more than its income and runs a deficit, or the US government does. It should be obvious which one is more sustainable over time. Government deficits need to be at least as big as the US current account deficit, in order for the private sector as a whole to save.

BM: How do you keep demand in balance with what the economy can provide? People have always talked about controlling deficits as a way to do that.

SK: If the problem is a mismatch between supply and demand, you could make the argument for less spending, but a better way to resolve the imbalance is through boosting supply. I sometimes imagine I’m watching a couple of runners. One of them is way out in the lead and he’s wearing a jersey that says “demand”. Then there’s somebody wearing the “supply” jersey, who is huffing and puffing, just trying to catch up. Why shorten the distance by kneecapping the guy who is in the lead? Maybe the other runner just needs an energy drink.

Think about the US in 2023. Deficits jumped way up, growth soared and inflation continued to cool. Clearly, you don’t need austerity to keep demand in balance with what the economy can provide. We’re building a lot of additional capacity, which helps supply catch up to demand. That’s a lot smarter than kneecapping the recovery.

BM: So to wrap this up, Stephanie, let’s imagine you’re in charge of the world economy. What’s your five-point plan?

SK: First, I would stop using interest rates for demand management and have central banks focus on things like financial stability. I would move to a permanent zero-interest rate policy and no government bonds for countries with sovereign currencies like the US.

Second, restore the primary role of fiscal policy in managing aggregate demand. Monetary policy has always been a sideshow. If you want to talk about what really works to stabilise the economy, it’s always been about fiscal policy.

Third, establish a proper fiscal union in the eurozone and introduce a new budgetary framework. Abandon arbitrary targets for debt-to-GDP or deficit-to-GDP ratios. Stop trying to keep government spending deficit neutral. Work to keep it inflation neutral.

Four, governments everywhere should budget for a job guarantee programme. That would be a very powerful automatic stabiliser for the economy. When people start to lose their jobs, the programme automatically absorbs them and helps them transition back into private employment.

It would truncate downturns, provide income support where it’s needed and enhance price stability.

BM: How so?

SK: Because the private sector does not like to hire the unemployed. When they’re trying to restaff, they go for their competitors’ employees and bid up their wages. That is where a lot of the wage pressure comes in. If you had a job guarantee, you’d have a ready pool of workers who have had their skills either maintained or upgraded through the downturn and are available to hire.

BM: And your plan’s last point?

SK: Nothing is more important than meaningful action on climate. Because climate breakdown will probably be the key driver of ongoing inflationary problems in the decades to come. Not to mention threatening our very survival on this planet.

The above transcript has been edited for brevity and clarity