Learn To Love Trillion-Dollar Deficits

Last week, a bipartisan group of 60 members of the U.S. House of Representatives sent a letter to congressional leadership, raising concerns about mounting debt and deficits that have come as a result of the federal government’s response to the coronavirus pandemic. “We cannot ignore the pressing issue of the national debt,” they wrote. The letter warned of “irreparable damage to our country” if nothing is done to stem the tide of red ink. Senator Mike Enzi, Republican of Wyoming, chairman of the Senate Budget Committee, echoed their concerns.

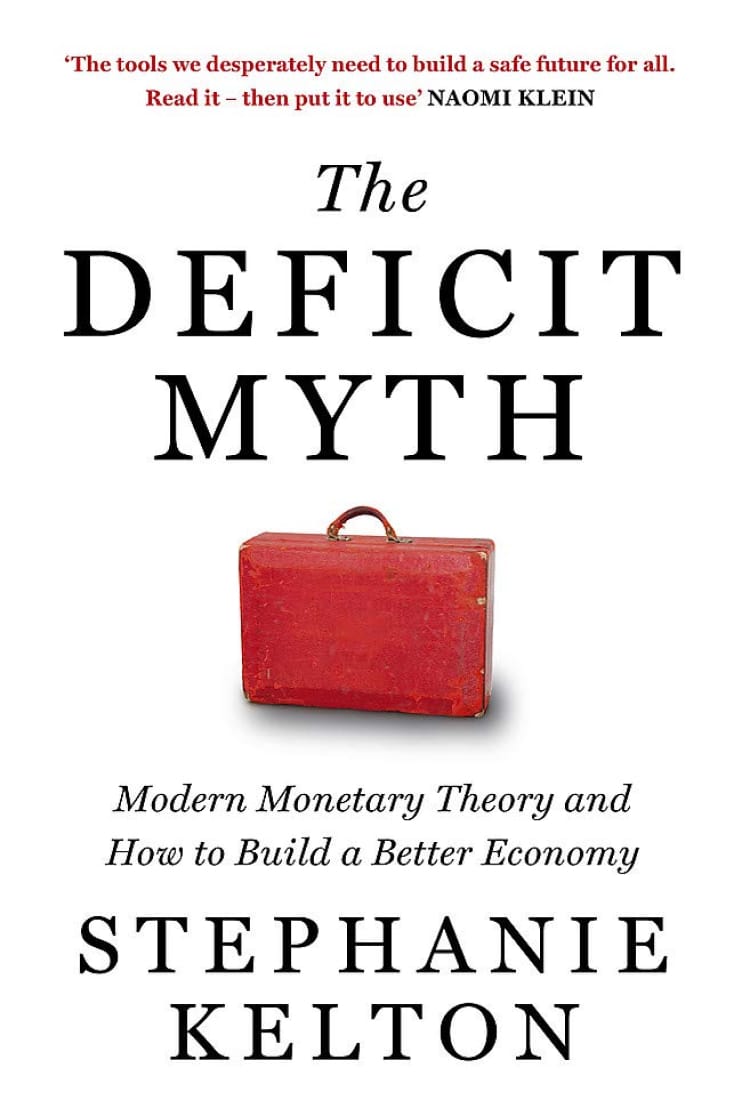

It’s an ominous sign for the smaller businesses and millions of unemployed Americans whose survival may very well depend on continued government support in this crisis. While these Democratic and Republican lawmakers stopped short of calling for immediate austerity measures, their remarks demonstrate that they have fallen prey to what I call the deficit myth: that our nation’s debt and deficits are on an unsustainable path and that we need to develop a plan to fix the problem.

As a proponent of what’s called Modern Monetary Theory and as a former chief economist for the Democrats on the Senate Budget Committee, intimately familiar with how public finance actually works, I am not worried about the recent multitrillion-dollar surge in spending.

But there was a time when it would have rattled me too.

I understand the deficit myth because in the early part of my career in economics I, too, bought into the conventional way of thinking. I was taught that the federal government should manage its finances in ways that resemble good old-fashioned household budgeting, that it should hold spending in line with revenues and avoid adding debt whenever possible.

Prime Minister Margaret Thatcher of Britain — President Ronald Reagan’s partner in the conservative revolution of the late 20th century — captured these sentiments in a seminal speech in 1983, declaring that “the state has no source of money other than the money people earn themselves. If the state wishes to spend more, it can only do so by borrowing your savings or by taxing you more.”

That thinking sounds reasonable to people, including me when I first absorbed it. But Mrs. Thatcher’s articulation of the deficit myth concealed a crucial reality: the monetary power of a currency-issuing government. Governments in nations that maintain control of their own currencies — like Japan, Britain and the United States, and unlike Greece, Spain and Italy — can increase spending without needing to raise taxes or borrow currency from other countries or investors. That doesn’t mean they can spend without limit, but it does mean they don’t need to worry about “finding the money,” as many politicians state, when they wish to spend more. Politics aside, the only economic constraints currency-issuing states face are inflation and the availability of labor and other material resources in the real economy.

It is true that in a bygone era, the U.S. government didn’t have full control of its currency. That’s because the U.S. dollar was convertible into gold, which forced the federal government to constrain its spending to protect the stock of its gold reserves. But President Richard Nixon famously ended the gold standard in August 1971, freeing the government to take full advantage of its currency-issuing powers. And yet, roughly a half-century later, top political leaders in the United States still talk as Ms. Thatcher did and legislate as though we, the taxpayers, are the ultimate source of the government’s money.

In 1997, during my early training as a professional economist, someone shared a little book titled “Soft Currency Economics” with me. Its author, Warren Mosler, a successful Wall Street investor, argued that when it came to money, debt and taxes, our politicians (and most economists) were getting almost everything wrong. I read it and wasn’t convinced. One of Mr. Mosler’s claims was that the money the government collects isn’t directly used to pay its bills. I had studied economics with world-renowned economists at Cambridge University, and none of my professors had ever said anything like that.

In 1998, I visited Mr. Mosler at his home in West Palm Beach, Fla., where I spent hours listening to him explain his thinking. He began by referring to the U.S. dollar as “a simple public monopoly.” Since the U.S. government is the sole issuer of the currency, he said, it was silly to think of Uncle Sam as needing to get dollars from the rest of us.

My head spun. Then he told me a story: Mr. Mosler had a beautiful beachfront property and all the luxuries of life anyone could hope to enjoy. He also had a family that included two teenagers, who resisted doing household chores. Mr. Mosler wanted the yard mowed, the beds made, the dishes done, the cars washed and so on. To encourage them to help out, he promised to compensate them by paying for their labor with his business cards. Nothing much got done.

“Why would we work for your business cards? They’re not worth anything!” they told him. So Mr. Mosler changed tactics. Instead of offering to compensate them for volunteering to pitch in around the house, he demanded a payment of 30 of his business cards, each month, with some chores worth more than others. Failure to pay would result in a loss of privileges: no more TV, use of the swimming pool or shopping trips to the mall.

Mr. Mosler had essentially imposed a tax that could be paid only with his own monogrammed paper. And he was prepared to enforce it. Now the cards were worth something. Before long, the kids were scurrying around, tidying up their bedrooms, the kitchen and the yard — working to maintain the lifestyle they wanted.

This, broadly speaking, is how our monetary system works. It is true that the dollars in your pocket are, in a physical sense, just pieces of paper. It’s the state’s ability to make and enforce its tax laws that sustains a demand for them, which in turn makes those dollars valuable. It’s also how the British Empire and others before it were able to effectively rule: conquer, erase the legitimacy of a given people’s original currency, impose British currency on the colonized, then watch how the entire local economy begins to revolve around British currency, interests and power. Taxes exist for many reasons, but they exist mainly to give value to a state’s otherwise worthless tokens.

Coming to terms with this was jarring — a Copernican moment. By the time I developed this subject into my first published, peer-reviewed academic paper, I realized that my prior understanding of government finance had been wrong.

In 2020, Congress has been showing us — in practice if not in its rhetoric — exactly how M.M.T. works: It committed trillions of dollars this spring that in the conventional economic sense it did not “have.” It didn’t raise taxes or borrow from China to come up with dollars to support our ailing economy. Instead, lawmakers simply voted to pass spending bills, which effectively ordered up trillions of dollars from the government’s bank, the Federal Reserve. In reality, that’s how all government spending is paid for.

M.M.T. simply describes how our monetary system actually works. Its explanatory power doesn’t depend on ideology or political party. Rather, the theory clarifies what is economically possible and shifts the terrain of policy debates currently hamstrung by nagging questions of so-called pay-fors: Instead of worrying about the number that falls out of the budget box at the end of each fiscal year, M.M.T. asks us to focus on the limits that matter.

At any point in time, every economy faces a sort of speed limit, regulated by the availability of its real productive resources — the state of technology and the quantity and quality of its land, workers, factories, machines and other materials. If any government tries to spend too much into an economy that’s already running at full speed, inflation will accelerate. So there are limits. However, the limits are not in our government’s ability to spend money or to sustain large deficits. What M.M.T. does is distinguish the real limits from wrongheaded, self-imposed constraints.

An understanding of Modern Monetary Theory matters greatly now. It could free policymakers not only to act boldly amid crises but also to invest boldly in times of more stability. It matters because to lift America out of its current economic crisis, Congress does not need to “find the money,” as many say, in order to spend more. It just needs to find the votes and the political will.