Q1: When did Social Security start?

A: The Social Security Act was signed by FDR on 8/14/35. Taxes were collected for the first time in January 1937 and the first one-time, lump-sum payments were made that same month. Regular ongoing monthly benefits started in January 1940.

Q2: What is the origin of the term “Social Security?”

A: The term was first used in the U.S. by Abraham Epstein in connection with his group, the American Association for Social Security. Originally, the Social Security Act of 1935 was named the Economic Security Act, but this title was changed during Congressional consideration of the bill. (The full story has been recounted by Professor Edwin Witte who was present at the event.)

Q3: When did Medicare start?

A: Medicare was passed into law on July 30, 1965 but beneficiaries were first able to sign-up for the program on July 1, 1966.

Q4: Is it true that Social Security was originally just a retirement program?

A: Yes. Under the 1935 law, what we now think of as Social Security only paid retirement benefits to the primary worker. A 1939 change in the law added survivors benefits and benefits for the retiree’s spouse and children. In 1956 disability benefits were added.

Keep in mind, however, that the Social Security Act itself was much broader than just the program which today we commonly describe as “Social Security.” The original 1935 law contained the first national unemployment compensation program, aid to the states for various health and welfare programs, and the Aid to Dependent Children program. (Full text of the 1935 law.)

Q5: Is it true that members of Congress do not have to pay into Social Security?

A: No, it is not true. All members of Congress, the President and Vice President, Federal judges, and most political appointees, were covered under the Social Security program starting in January 1984. They pay into the system just like everyone else. Thus all members of Congress, no matter how long they have been in office, have been paying into the Social Security system since January 1984.

(Prior to this time, most Federal government workers and officials were participants in the Civil Service Retirement System (CSRS) which came into being in 1920–15 years before the Social Security system was formed. For this reason, historically, Federal employees were not participants in the Social Security system.)

Employees of the three branches of the federal government, were also covered starting in January 1984, under the 1983 law–but with some special transition rules.

- Executive and judicial branch employees hired before January 1, 1984 were given a one-time irrevocable choice of whether to switch to Social Security or stay under the old CSRS. (Rehired employees–other than rehired annuitants–are treated like new employees if their break-in-service was more than a year.)

- Employees of the legislative branch who were not participating in the CSRS system were mandatorily covered, regardless of when their service began. Those who were in the CSRS system were given the same one-time choice as employees in the executive and judicial branches.

- All federal employees hired on or after January 1, 1984 are mandatorily covered under Social Security–the CSRS system is not an option for them.

So there are still some Federal employees, those first hired prior to January 1984, who are not participants in the Social Security system. All other Federal government employees participate in Social Security like everyone else.

This change was part of the 1983 Amendments to Social Security. You can find a summary of the 1983 amendments elsewhere on this site.

Q6: Is is true that the age of 65 was chosen as the retirement age for Social Security because the Germans used 65 in their system, and the Germans used age 65 because their Chancellor, Otto von Bismarck, was 65 at the time they developed their system?

A: No, it is not true. Generally, age 65 was chosen to conform to contemporary practice during the 1930s.

More details:

Germany became the first nation in the world to adopt an old-age social insurance program in 1889, designed by Germany’s Chancellor, Otto von Bismarck. The idea was first put forward, at Bismarck’s behest, in 1881 by Germany’s Emperor, William the First, in a ground-breaking letter to the German Parliament. William wrote: “. . . those who are disabled from work by age and invalidity have a well-grounded claim to care from the state.”

One persistent myth about the German program is that it adopted age 65 as the standard retirement age because that was Bismarck’s age. In fact, Germany initially set age 70 as the retirement age (and Bismarck himself was 74 at the time) and it was not until 27 years later (in 1916) that the age was lowered to 65. By that time, Bismarck had been dead for 18 years.

By the time America moved to social insurance in 1935 the German system was using age 65 as its retirement age. But this was not the major influence on the Committee on Economic Security (CES) when it proposed age 65 as the retirement age under Social Security. This decision was not based on any philosophical principle or European precedent. It was, in fact, primarily pragmatic, and stemmed from two sources. One was a general observation about prevailing retirement ages in the few private pension systems in existence at the time and, more importantly, the 30 state old-age pension systems then in operation. Roughly half of the state pension systems used age 65 as the retirement age and half used age 70. The new federal Railroad Retirement System passed by Congress earlier in 1934, also used age 65 as its retirement age. Taking all this into account, the CES planners made a rough judgment that age 65 was probably more reasonable than age 70. This judgment was then confirmed by the actuarial studies. The studies showed that using age 65 produced a manageable system that could easily be made self-sustaining with only modest levels of payroll taxation. So these two factors, a kind of pragmatic judgment about prevailing retirement standards and the favorable actuarial outcome of using age 65, combined to be the real basis on which age 65 was chosen as the age for retirement under Social Security. With all due respect to Chancellor Bismarck, he had nothing to do with it.

Q7: Is it true that life expectancy was less than 65 back in 1935, so the Social Security program was designed in such a way that people would not live long enough to collect benefits?

A: Not really. Life expectancy at birth was less than 65, but this is a misleading measure. A more appropriate measure is life expectancy after attainment of adulthood, which shows that most Americans could expect to live to age 65 once they survived childhood.

More details:

If we look at life expectancy statistics from the 1930s we might come to the conclusion that the Social Security program was designed in such a way that people would work for many years paying in taxes, but would not live long enough to collect benefits. Life expectancy at birth in 1930 was indeed only 58 for men and 62 for women, and the retirement age was 65. But life expectancy at birth in the early decades of the 20th century was low due mainly to high infant mortality, and someone who died as a child would never have worked and paid into Social Security. A more appropriate measure is probably life expectancy after attainment of adulthood.

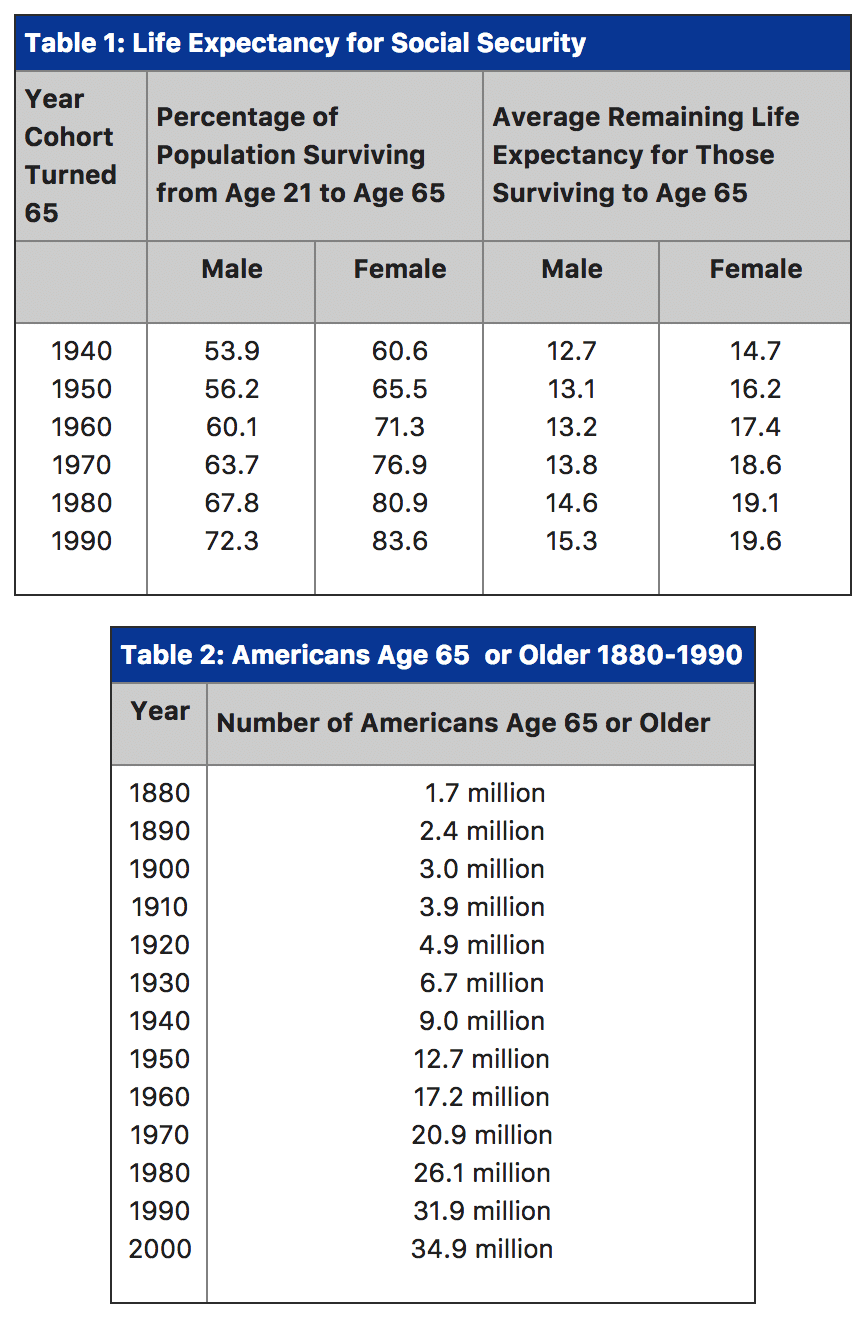

As Table 1 shows, the majority of Americans who made it to adulthood could expect to live to 65, and those who did live to 65 could look forward to collecting benefits for many years into the future. So we can observe that for men, for example, almost 54% of the them could expect to live to age 65 if they survived to age 21, and men who attained age 65 could expect to collect Social Security benefits for almost 13 years (and the numbers are even higher for women).

Also, it should be noted that there were already 7.8 million Americans age 65 or older in 1935 (cf. Table 2), so there was a large and growing population of people who could receive Social Security. Indeed, the actuarial estimates used by the Committee on Economic Security (CES) in designing the Social Security program projected that there would be 8.3 million Americans age 65 or older by 1940 (when monthly benefits started). So Social Security was not designed in such a way that few people would collect the benefits.

As Table 1 indicates, the average life expectancy at age 65 (i.e., the number of years a person could be expected to receive unreduced Social Security retirement benefits) has increased a modest 5 years (on average) since 1940. So, for example, men attaining 65 in 1990 can expect to live for 15.3 years compared to 12.7 years for men attaining 65 back in 1940.

(Increases in life expectancy are a factor in the long-range financing of Social Security; but other factors, such as the sheer size of the “baby boom” generation, and the relative proportion of workers to beneficiaries, are larger determinants of Social Security’s future financial condition.)

Q8: When did COLAs (cost-of-living allowances) start?

A: COLAs were first paid in 1975 as a result of a 1972 law. Prior to this, benefits were increased irregularly by special acts of Congress.

The Story of COLAs:

Most people are aware that there are annual increases in Social Security benefits to offset the corrosive effects of inflation on fixed incomes. These increases, now known as Cost of Living Allowances (COLAs), are such an accepted feature of the program that it is difficult to imagine a time when there were no COLAs. But in fact, when Ida May Fuller received her first $22.54 benefit payment in January of 1940, this would be the same amount she would receive each month for the next 10 years. For Ida May Fuller, and the millions of other Social Security beneficiaries like her, the amount of that first benefit check was the amount they could expect to receive for life. It was not until the 1950 Amendments that Congress first legislated an increase in benefits. Current beneficiaries had their payments recomputed and Ida May Fuller, for example, saw her monthly check increase from $22.54 to $41.30.

These recomputations were effective for September 1950 and appeared for the first time in the October 1950 checks. A second increase was legislated for September 1952. Together these two increases almost doubled the value of Social Security benefits for existing beneficiaries. From that point on, benefits were increased only when Congress enacted special legislation for that purpose.

In 1972 legislation the law was changed to provide, beginning in 1975, for automatic annual cost-of-living allowances (i.e., COLAs) based on the annual increase in consumer prices. No longer do beneficiaries have to await a special act of Congress to receive a benefit increase and no longer does inflation drain value from Social Security benefits.

Q9: What information is available from Social Security records to help in genealogical research?

A: You might want to start by checking out the Social Security Death Index which is available online from a variety of commercial services (usually the search is free). The Death Index contains a listing of persons who had a Social Security number, who are deceased, and whose death was reported to the Social Security Administration. (The information in the Death Index for people who died prior to 1962 is sketchy since SSA’s death information was not automated before that date. Death information for persons who died before 1962 is generally only in the Death Index if the death was actually reported to SSA after 1962, even though the death occurred prior to that year.)

If you find a person in the Death Index you will learn the date of birth and Social Security Number for that person. (The Social Security Death Index is not published by SSA for public use, but is made available by commercial entities using information from SSA records. We do not offer support of these commercial products nor can we answer questions about the material in the Death Index.)

Other records potentially available from SSA include the Application for a Social Security Number (form SS-5). To obtain any information from SSA you will need to file a Freedom of Information Act (FOIA) request.

Q10: Does Social Security have any lists of the most common names in use in the U.S.?

A: Yes, based on the applications for Social Security cards, SSA’s Office of the Actuary has done a series of special studies of the most common names.

Q11: Where do I get more information about the Social Security program as it exists today?

A: Go to the Social Security Online home page.

Q12: Who was the first person to get Social Security benefits?

A: A fellow named Ernest Ackerman got a payment for 17 cents in January 1937. This was a one-time, lump-sum pay-out–which was the only form of benefits paid during the start-up period January 1937 through December 1939.

Q13: If Ernest Ackerman only received a single lump-sum payment, who was the first person to received ongoing monthly benefits?

A: A woman named Ida May Fuller , from Ludlow, Vermont was the first recipient of monthly Social Security benefits.

Q14: How many people, annually, have received Social Security payments?

A: This history is available as a detailed table. (Payment history table)

There is also a (PDF-format) table which shows the minimum and maximum Retirement Benefit amounts over the years.

Q15: What is the “notch”?

A: In 1972 a technical error was introduced in the law which resulted in beneficiaries getting a double adjustment for inflation. In 1977 Congress acted to correct the error. Instead of making the correction immediate, they phased it in over a five year period (this is the notch period). This phase-in period was defined as affecting those people born in 1917-1921. Individuals in the notch generally receive higher benefits than those born after the notch, although they receive lower benefits than those born in the period prior to the notch when the error was in effect.

Q16: Where can I find the history of the tax rates over the years and the amount of earnings subject to Social Security taxes?

A: The history of the tax rates is available as an Adobe PDF file. (Tax rate table). There is also a table showing the maximum amount of Social Security taxes that could have been paid since the program began.

There are also tables showing the minimum and maximum Social Security benefitfor a retired worker who retires at age 62 and one who retires at age 65.

Also, there is a table showing the number of workers paying into Social Security each year. (Covered workers table) And also a table showing the ratio of covered workers to beneficiaries. (Ratio table)

Q17: What does FICA mean and why are Social Security taxes called FICA contributions?

A: Social Security payroll taxes are collected under authority of the Federal Insurance Contributions Act (FICA). The payroll taxes are sometimes even called “FICA taxes.” In the original 1935 law the benefit provisions were in Title II of the Act and the taxing provisions were in a separate title, Title VIII. As part of the 1939 Amendments, the Title VIII taxing provisions were taken out of the Social Security Act and placed in the Internal Revenue Code. Since it wouldn’t make any sense to call this new section of the Internal Revenue Code “Title VIII,” it was renamed the “Federal Insurance Contributions Act.” So FICA is nothing more than the tax provisions of the Social Security Act, as they appear in the Internal Revenue Code.

Q18: Is there any significance to the numbers assigned in the Social Security Number?

A: Yes. Originally, the first three digits are assigned by the geographical region in which the person was residing at the time he/she obtained a number. Generally, numbers were assigned beginning in the northeast and moving westward. So people on the east coast have the lowest numbers and those on the west coast have the highest numbers. The remaining six digits in the number are more or less randomly assigned and were organized to facilitate the early manual bookkeeping operations associated with the creation of Social Security in the 1930s.

Beginning on June 25, 2011, the SSA implemented a new assignment methodology for Social Security Numbers. The project is a forward looking initiative of the Social Security Administration (SSA) to help protect the integrity of the SSN by establishing a new randomized assignment methodology. SSN Randomization will also extend the longevity of the nine-digit SSN nationwide.

For more information on the randomization of Social Security Numbers, please visit this website:

http://ssa.gov/employer/randomizationfaqs.html#a0=-1

Q19: How many Social Security numbers have been issued since the program started?

A: Social Security numbers were first issued in November 1936. To date, 453.7 million different numbers have been issued.

Q20: Are Social Security numbers reused after a person dies?

A: No. We do not reassign a Social Security number (SSN) after the number holder’s death. Even though we have issued over 453 million SSNs so far, and we assign about 5 and one-half million new numbers a year, the current numbering system will provide us with enough new numbers for several generations into the future with no changes in the numbering system.

Q21: When did Social Security cards bear the legend “NOT FOR IDENTIFICATION”?

A: The first Social Security cards were issued starting in 1936, they did not have this legend. Beginning with the sixth design version of the card, issued starting in 1946, SSA added a legend to the bottom of the card reading “FOR SOCIAL SECURITY PURPOSES — NOT FOR IDENTIFICATION.” This legend was removed as part of the design changes for the 18th version of the card, issued beginning in 1972. The legend has not been on any new cards issued since 1972.

Q22: Does the Social Security Number contain a code indicating the racial group to which the cardholder belongs?

A: No. This is a myth. The Social Security Number does contain a segment (the two middle numbers) known as “the group number.” But this refers only to the numerical groups 01-99. It has nothing to do with race.

More detailed information on the Group Number:

Apparently due to the fact that the middle digits of the SSN are referred to as the “group number,” some people have misconstrued this to mean that the “group number” refers to racial groupings. So a myth goes around from time-to-time that encoded in a person’s SSN is a key to their race. This simply is not true.

As should be clear from the explanation of the SSN numbering scheme, the “group number” refers only to the numerical groups 01-99. For filing purposes, the “area numbers” are broken down into these numerical subgroups. So, for example, for area numbers starting with 527 there would be 99 subgroups, one for every number starting with 527-01, and one for every number starting with 527-02, and so on. This was done back in 1936 because in that era there were no computers and all the records were stored in filing cabinets. The early program administrators needed some way to organize the filing cabinets into sub-groups, to make them more manageable, and this is the scheme they came up with.

So the “group number” has nothing whatever to do with race.

More detailed information on the Numbering Scheme:

Number Has Three Parts

The nine-digit SSN is composed of three parts:

- The first set of three digits is called the Area Number

- The second set of two digits is called the Group Number

- The final set of four digits is the Serial Number

The Area Number

The Area Number is assigned by the geographical region. Prior to 1972, cards were issued in local Social Security offices around the country and the Area Number represented the State in which the card was issued. This did not necessarily have to be the State where the applicant lived, since a person could apply for their card in any Social Security office. Since 1972, when SSA began assigning SSNs and issuing cards centrally from Baltimore, the area number assigned has been based on the ZIP code in the mailing address provided on the application for the original Social Security card. The applicant’s mailing address does not have to be the same as their place of residence. Thus, the Area Number does not necessarily represent the State of residence of the applicant, either prior to 1972 or since.

Generally, numbers were assigned beginning in the northeast and moving westward. So people on the east coast have the lowest numbers and those on the west coast have the highest numbers.

Note: One should not make too much of the “geographical code.” It is not meant to be any kind of useable geographical information. The numbering scheme was designed in 1936 (before computers) to make it easier for SSA to store the applications in our files in Baltimore since the files were organized by regions as well as alphabetically. It was really just a bookkeeping device for our own internal use and was never intended to be anything more than that.

Group Number

Within each area, the group number (middle two (2) digits) range from 01 to 99 but are not assigned in consecutive order. For administrative reasons, group numbers issued first consist of the ODD numbers from 01 through 09 and then EVEN numbers from 10 through 98, within each area number allocated to a State. After all numbers in group 98 of a particular area have been issued, the EVEN Groups 02 through 08 are used, followed by ODD Groups 11 through 99.

Serial Number

Within each group, the serial numbers (last four (4) digits) run consecutively from 0001 through 9999.

Q23: Has Social Security ever been financed by general tax revenues?

A: Not to any significant extent.

Detailed explanation of the Design of the Original Social Security Act:

The new social insurance program the Committee on Economic Security (CES) was designing in 1934 was different than welfare in that it was a contributory program in which workers and their employers paid for the cost of the benefits–with the government’s role being that of the fund’s administrator, rather than its payer. This was very important to President Roosevelt who signaled early on that he did not want the federal government to subsidize the program–that it was to be “self-supporting.” He would eventually observe: “If I have anything to say about it, it will always be contributed, both on the part of the employer and the employee, on a sound actuarial basis. It means no money out of the Treasury.”

But some members of the CES did not understand “self-supporting” with quite the same purity as the President did. They saw no reason why general revenues could not be used– especially in the context of the overall approach to old-age security. FDR, and the members of the CES, believed that old-age assistance was a temporary stop-gap which would eventually completely disappear as social insurance became established. At a November 27, 1934 meeting the staff displayed a large wall-chart showing two trend lines, one for old-age assistance and one for the social insurance program. The line for old-age assistance was heading down while that for social insurance was heading up. At the point where they intersected, social insurance would have assumed the bulk of the burden of providing old-age security in America. Thus, general revenue expenses for old-age assistance would steadily diminish, thanks to Social Security. The staff reasoned that it was sensible to take a portion of this savings and use it to finance the Social Security program in the out-years–thus keeping payroll tax rates lower than they otherwise would have to be. Using this rationale, the CES proposal presented to FDR contained a tax schedule which financed the program by payroll taxes until 1965, at which point a general revenue subsidy would kick-in. Eventually, under the CES plan, general revenues would finance about one-third of the cost of the benefits.

The Committee’s report was late. It was due to Congress on January 1, 1935 but it was not finished and presented to the President until January 15th. Immediately upon receiving the report the President sent notice to Congress that he would be transmitting the report to them on the 17th, then he sat down to read the report. FDR very carefully went over the actuarial tables and discovered to his surprise that the program was not fully “self- supporting” as he had directed it should be. He summoned Secretary Perkins to the White House on the afternoon of the 16th to tell her that there must be some mistake in the actuarial tables because they showed a large federal subsidy beginning in 1965. When informed that this was no mistake, the President made it clear it was indeed a mistake, although of a different kind! He told the Secretary to get to work immediately to devise a fully self-sustaining old age insurance system. The report was transmitted to the Congress on the 17th as the President had promised, but the actuarial table in question was withdrawn until it could be reworked. Bob Myers, later to be SSA’s Chief Actuary, was given the assignment to rework the financing and the system finally devised projected a $47 billion surplus by 1980–with no general revenue financing.

Detailed explanation of the Beginning of Small General Revenue Subsidies:

And so, Social Security was from its first day of operation a fully self-supporting program, without any general revenue funding. But FDR’s sense of purity was ultimately left behind when Congress voted the first subsidy provisions to be added to Social Security. Ever since World War II it was recognized that there was a problem for people who entered the service of their country in the military. Immediately following World War II Congress passed a brief change to Social Security which provided some small general revenues to pay benefits to WWII veterans who had become disabled in the years immediately following the War and who did not qualify for a veterans benefit. From 1947-1951 a total of $16 million was transferred into the Trust Funds for this purpose.

Since military wages were not covered employment until 1957, spending several years in the military would result in reduced Social Security benefits. Even after military service became a form of covered employment, the low cash wages paid to servicemen and women meant that military service was also a financial sacrifice. As a special benefit for members of the armed forces the Congress decided to grant special non-contributory wage credits for military service before 1957 and special deemed military wage credits to boost the amounts of credited contributions for service after 1956. These credits were paid out of general revenues as a subsidy to military personnel. So, each year since 1966 the Social Security Trust Funds have in fact received some relatively small transfers from the general revenues as bonuses for military personnel.

In 1965-66 Congress also identified another “disadvantaged” group: elderly individuals (age 72 before 1971) who had not been able to work long enough under Social Security to become insured for a benefit. People in this group were granted special Social Security benefits paid for entirely by the general revenues of the Treasury. These were known as Special Age 72, or Prouty, benefits. Over time, of course, these beneficiaries will disappear as Father Time claims members of the group.

Finally, as part of the 1983 Amendments, Social Security benefits became subject to federal income taxes for the first time, and the monies generated by this taxation are returned to the Trust Funds from general revenues–the third and last source of general revenue financing of Social Security.

All three of these general revenue streams are so small relative to the payroll tax funding that for most practical purposes we could still accurately describe the Social Security program as “self-supporting.”

Q24: How much has Social Security paid out since it started?

A: From 1937 (when the first payments were made) through 2009 the Social Security program has expended $11.3 trillion.

Q25: How much has Social Security taken in taxes and other income since it started?

A: From 1937 (when taxes were first collected) through 2009 the Social Security program has received $13.8 trillion in income.

Q26: Has Social Security always taken in more money each year than it needed to pay benefits?

A: No. So far there have been 11 years in which the Social Security program did not take enough in FICA taxes to pay the current year’s benefits. During these years, Trust Fund bonds in the amount of about $24 billion made up the difference.

Q27: Do the Social Security Trust Funds earn interest?

A: Yes they do. By law, the assets of the Social Security program must be invested in securities guaranteed as to both principal and interest. The Trust Funds hold a mix of short-term and long-term government bonds. The Trust Funds can hold both regular Treasury securities and “special obligation” securities issued only to federal trust funds. In practice, most of the securities in the Social Security Trust Funds are of the “special obligation” type. (See additional explanation from SSA’s Office of the Actuary.)

The Trust Funds earn interest which is set at the average market yield on long-term Treasury securities. Interest earnings on the invested assets of the combined OASI and DI Trust Funds were $55.5 billion in calendar year 1999. This represented an effective annual interest rate of 6.9 percent.

The Trust Funds have earned interest in every year since the program began. More detailed information on the Trust Fund investments can be found in the Annual Report of the Social Security Trustees and on the Actuary’s webpages concerning the Investment Transactions and Investment Holdings of the Trust Funds.

Q28: Did President Franklin Roosevelt make a set of promises about Social Security, which have now been violated?

A: This question generally refers to a set of misinformation that is propagated over the Internet (usually via email) from time to time.

More details about Myths:

Myth 1: President Roosevelt promised that participation in the program would be completely voluntary

Persons working in employment covered by Social Security are subject to the FICA payroll tax. Like all taxes, this has never been voluntary. From the first days of the program to the present, anyone working on a job covered by Social Security has been obligated to pay their payroll taxes.

In the early years of the program, however, only about half the jobs in the economy were covered by Social Security. Thus one could work in non-covered employment and not have to pay FICA taxes (and of course, one would not be eligible to collect a future Social Security benefit). In that indirect sense, participation in Social Security was voluntary. However, if a job was covered, or became covered by subsequent law, then if a person worked at that job, participation in Social Security was mandatory.

There have only been a handful of exceptions to this rule, generally involving persons working for state/local governments. Under certain conditions, employees of state/local governments have been able to voluntarily choose to have their employment covered or not covered.

Myth 2: President Roosevelt promised that the participants would only have to pay 1% of the first $1,400 of their annual incomes into the program

The tax rate in the original 1935 law was 1% each on the employer and the employee, on the first $3,000 of earnings. This rate was increased on a regular schedule in four steps so that by 1949 the rate would be 3% each on the first $3,000. The figure was never $,1400, and the rate was never fixed for all time at 1%.

(The text of the 1935 law and the tax rate schedule can be found here.)

Myth 3: President Roosevelt promised that the money the participants elected to put into the program would be deductible from their income for tax purposes each year

There was never any provision of law making the Social Security taxes paid by employees deductible for income tax purposes. In fact, the 1935 law expressly forbid this idea, in Section 803 of Title VIII.

(The text of Title VIII. can be found here.)

Myth 4: President Roosevelt promised that the money the participants paid would be put into the independent “Trust Fund,” rather than into the General operating fund, and therefore, would only be used to fund the Social Security Retirement program, and no other Government program

The idea here is basically correct. However, this statement is usually joined to a second statement to the effect that this principle was violated by subsequent Administrations. However, there has never been any change in the way the Social Security program is financed or the way that Social Security payroll taxes are used by the federal government.

The Social Security Trust Fund was created in 1939 as part of the Amendments enacted in that year. From its inception, the Trust Fund has always worked the same way. The Social Security Trust Fund has never been “put into the general fund of the government.”

Most likely this myth comes from a confusion between the financing of the Social Security program and the way the Social Security Trust Fund is treated in federal budget accounting. Starting in 1969 (due to action by the Johnson Administration in 1968) the transactions to the Trust Fund were included in what is known as the “unified budget.” This means that every function of the federal government is included in a single budget. This is sometimes described by saying that the Social Security Trust Funds are “on-budget.” This budget treatment of the Social Security Trust Fund continued until 1990 when the Trust Funds were again taken “off-budget.” This means only that they are shown as a separate account in the federal budget. But whether the Trust Funds are “on-budget” or “off-budget” is primarily a question of accounting practices–it has no affect on the actual operations of the Trust Fund itself.

Myth 5: President Roosevelt promised that the annuity payments to the retirees would never be taxed as income

Originally, Social Security benefits were not taxable income. This was not, however, a provision of the law, nor anything that President Roosevelt did or could have “promised.” It was the result of a series of administrative rulings issued by the Treasury Department in the early years of the program. (The Treasury rulings can be found here.)

In 1983 Congress changed the law by specifically authorizing the taxation of Social Security benefits. This was part of the 1983 Amendments, and this law overrode the earlier administrative rulings from the Treasury Department. (A detailed explanation of the 1983 Amendments can be found here.)

Q29: I have seen a set of questions and answers on the Internet concerning who started the taxing of Social Security benefits, and questions like that. Are the answers given correct?

A: There are many varieties of questions and answers of this form circulating on the Internet. One fairly widespread form of the questions is filled with misinformation. (See a detailed explanation here.) We recommend that Internet users refer to SSA’s official Questions and Answers section on our homepage for reliable information (go to www.socialsecurity.gov for the Q & A section.)